Articles

Forex Broker Risk Management: Essential Strategies + Prop Firms Included

Understanding the Forex Broker Risk Management Landscape

Between 80 and 100 proprietary trading firms collapsed in 2024, and forex broker risk management – or the lack of it – wasn’t the simple explanation everyone expected.

At YourFintech, we spent three weeks analyzing these failures, expecting to find the usual suspects: inadequate capital, poor technology, inexperienced management. What we found instead? Many of these firms had sophisticated systems. Experienced operators. Some had been running successfully for 5+ years. The pattern wasn’t “good risk management vs bad risk management” – it was messier than that.

The forex market moves $9.6 trillion daily, which everyone knows. What’s less discussed is how this creates risk exposure that behaves differently than most operators expect. Not just larger exposure – differently behaving exposure.

Source: bis.org

Here’s what we’ve concluded after looking at the wreckage: forex broker risk management isn’t about implementing every possible control (though vendors will try to sell you that story). It’s about matching specific controls to your business model and growth trajectory. Get that wrong and sophisticated systems won’t save you.

Risk management functions as the operational framework protecting firm capital and ensuring regulatory compliance, yes. But the relationship between “comprehensive frameworks” and actual survival is more nuanced than you’ll hear at industry conferences. We’ve seen firms with bare-bones systems survive events that killed firms with enterprise-grade infrastructure.

Distinguishing Broker-Side from Trader-Side Risk Management

This guide focuses on protecting your brokerage or prop firm business. Not individual trading accounts.

Retail traders manage position sizing and stop-losses for their own capital. You face aggregate client positions, counterparty defaults, LP failures, technology infrastructure risks, regulatory violations. A single hedging miscalculation can eliminate months of profits – we watched this happen to a broker in March 2024, lost $340K in about 90 minutes because their hedge routing lagged by 45 seconds during volatility.

Prop firms have additional challenges around payout obligations and the timing gap between revenue generation and capital outflows. Our analysis of 2024 failures shows most stemmed from underestimating this timing mismatch. Not market risk. Not fraud. Just misunderstanding cash flow timing.

Firm-level risks compound differently than individual trading risks. One profitable trader offsets losses from several losing traders (thank god). But systemic risks – platform outages, LP failures, regulatory penalties – hit everything simultaneously. No diversification benefit. No offset.

Key Risk Categories in Forex Broker Risk Management

Market Risk

Market risk is losses from adverse price movements in aggregate client positions.

If you’re managing $50M+ in client equity, expect exposure fluctuations of 15-30% during high-volatility periods. Not occasionally. Regularly. The 2024 market conditions showed this clearly – seemed like every major economic announcement came with some surprise attached that moved volatility in ways the models didn’t predict.

B-Book execution models internalize client trades, creating direct market risk. Markets move against you, losses stack up. Even A-Book brokers routing to LPs face basis risk – that gap between when your client’s trade executes and when you get the hedge placed. That gap is where money disappears.

Effective forex broker risk management requires hedging protocols that adapt in real-time. Not react after losses hit. By then you’re just documenting damage.

Credit and Counterparty Risk

Credit risk emerges when clients can’t meet margin calls or counterparties fail to honor obligations.

COVID-19 in 2020 provided interesting data. Some brokers with substantial capital buffers still experienced severe stress. Smaller operations sometimes navigated it more smoothly. Our hypothesis at YourFintech: capital buffer deployment matters more than size. How quickly can you access it? What form does it exist in? Is it actually available when you need it, or tied up in illiquid assets?

LP diversification reduces counterparty risk but doesn’t eliminate it. If your primary LP has technical issues or (worse) financial problems, you face wider spreads, execution delays, complete market access loss. Multiple credit lines create operational headaches but provide essential redundancy.

Prop firms face unique credit dynamics around payout structures. Revenue today, payout obligations in 60-90 days. Several 2024 collapses came specifically from this. What we’re still trying to understand: was this truly unpredictable or were there early warning indicators that operators missed?

Operational Risk

Technology infrastructure failures concern us more than most risk categories because consequences are so immediate.

Your platform must handle peak trading volumes without latency or crashes. Must. Not should.

We know of one broker – mid-sized operation, decent reputation – with a 47-minute outage during a BoE announcement in September 2024. Direct losses around $180K. Client departures over the next 90 days? Over $4M in equity walked out. Word spreads fast in trading communities, and once you get tagged as “the broker that crashes during news” you’re done.

What’s interesting: several other brokers had similar-duration outages around the same period without comparable client exodus. Reputational damage isn’t just a function of failure frequency. Client communication matters. Relationship quality matters. Timing and luck matter too, probably.

Human error in trade execution, risk configuration, or hedging triggers significant losses. Standard controls: segregation of duties, dual-approval processes, comprehensive audit trails. Do these actually prevent errors or just create documentation trails? Both, probably. Though our analysis suggests documentation function is more reliable than prevention function.

Fraud – internal and external – poses ongoing threats. Cybersecurity attacks are constant now, not theoretical.

Regulatory Compliance Risk in Forex Brokerage Management

Regulatory requirements vary by jurisdiction but consistently demand robust compliance frameworks. In the United States, forex brokers need $20 million minimum net capital and registration with both the CFTC and NFA. European brokers under MiFID face similar requirements.

Regulatory scrutiny intensified in 2024-2025. Enforcement agencies now use AI-driven monitoring to detect unusual trading patterns, spread manipulation, and misleading marketing. The NFA issued a $350,000 fine to one broker for inflating spreads during volatile news events.

What concerns our team: enforcement asymmetry. Some violations trigger massive penalties, others receive warnings. The logic isn’t always transparent to firms trying to ensure compliance.

AML and KYC compliance require continuous transaction monitoring, sanctions screening, and beneficial ownership verification. Joint CFTC and FinCEN enforcement actions target inadequate AML programs. Marketing compliance has also intensified – how you present leverage and risk to retail clients faces increased scrutiny.

Liquidity Risk

Liquidity risk emerges when you can’t meet withdrawal requests or margin requirements.

Pattern we’ve observed: rapid growth masks liquidity issues until growth plateaus. Everything seems fine during expansion (revenue coming in faster than obligations going out). Then growth slows and obligations catch up. This happened to at least three firms we’re aware of in the last 18 months. One had been operating successfully for 7 years before this caught up with them.

Brokers face liquidity pressures during market stress when margin calls spike simultaneously. Insufficient reserves force withdrawal restrictions or reduced leverage offerings. Both damage client relationships and reputation, and once that damage sets in recovery is expensive and slow.

Reputational Risk

Reputational damage from risk management failures destroys client confidence more permanently than direct financial losses.

One publicized incident – missed payouts, platform failures, regulatory sanctions – triggers withdrawals and stops new acquisition. Social media and trading forums amplify these issues at insane speed.

What’s tricky: the same operational failure produces vastly different reputational consequences depending on context, timing, client communication, competitive landscape. Makes it difficult to invest appropriately in reputation protection. You might be over-investing or under-investing and won’t know which until after an incident occurs.

Essential Forex Broker Risk Management Strategies

Here are strategies we consider essential based on consistent evidence. Though our confidence level varies significantly across different recommendations – some we’re quite certain about, others reflect industry consensus we’re somewhat skeptical of but can’t definitively refute.

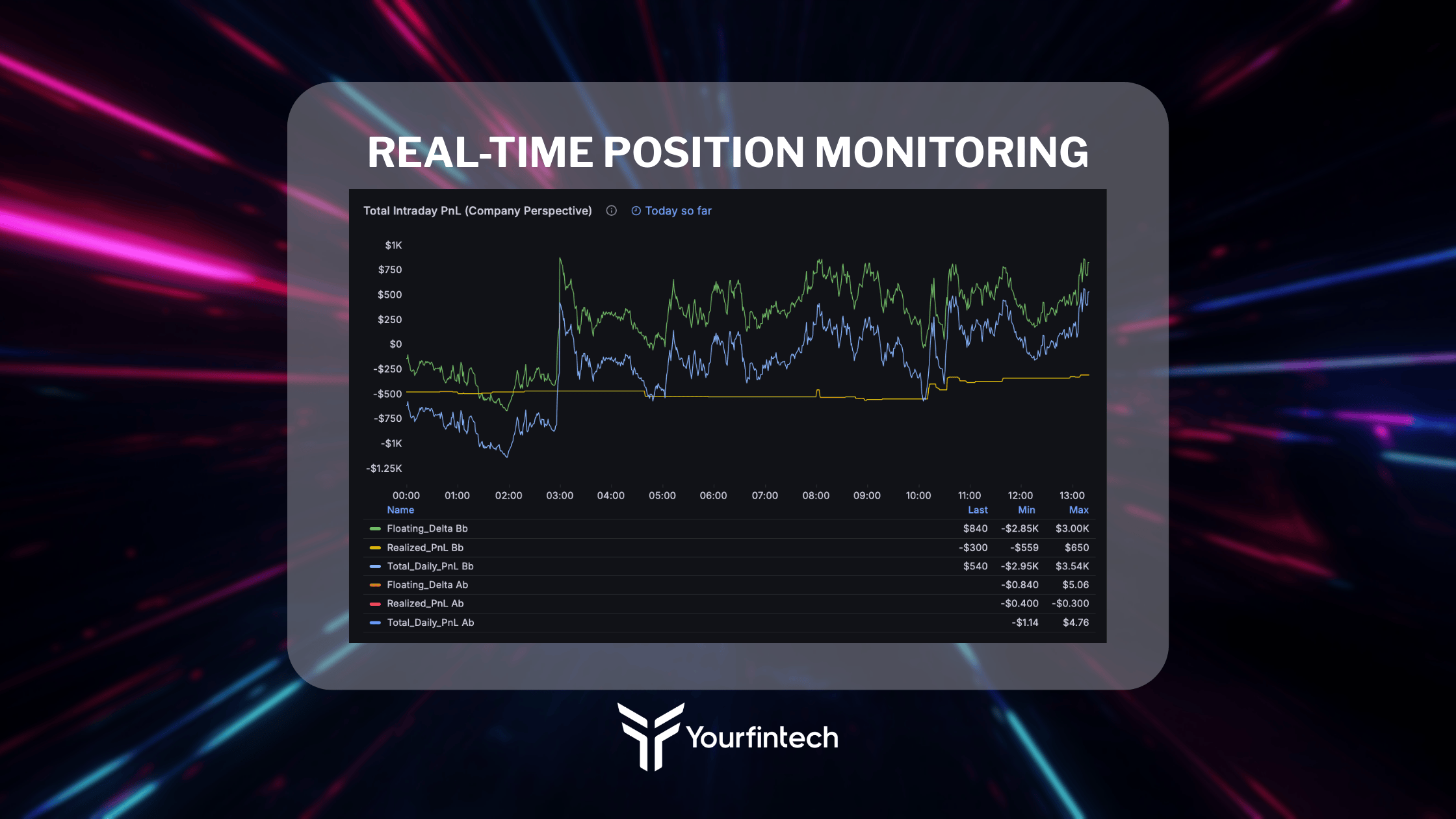

Real-Time Position Monitoring for Forex Risk Management

Modern platforms aggregate position data in real-time, calculating net exposure by currency pair, asset class, time horizon. Should track current positions and pending orders that will alter exposure upon execution.

During high-volatility, exposure shifts in seconds. Automated monitoring with threshold alerts enables rapid response. Should extend beyond long/short calculations to include correlation risk, option Greeks, concentration risk from large clients.

If you’re calculating position risk manually in spreadsheets… that might work for very small operations with simple books. Doesn’t scale. Error probability under stress is unacceptably high.

Dynamic Margin Requirements in Broker Risk Control

Dynamic margin systems adjust requirements based on current volatility, time of day, upcoming announcements, historical client behavior. Static margins that don’t account for changing conditions are suboptimal.

November 2024 crypto surge demonstrated this clearly. Brokers that proactively adjusted margins before regulatory mandates maintained better capital positions than reactive firms (though this is based on limited observations and might not replicate under different conditions).

Client segmentation enables customized margins. Higher for riskier clients, preferential for proven profitable clients. What we’re less certain about: whether typical segmentation criteria (deposit size, frequency, profitability history) actually predict future risk or just pattern-match on historical data in ways that don’t generalize forward.

Broker Hedging Strategies and Execution Models

Execution models fundamentally determine risk exposure. A-Book routes orders to external LPs. Eliminates market risk, reduces profit margins to spreads and commissions. B-Book internalizes trades. Creates market risk but potentially higher profits when clients lose (and statistically, most retail clients do lose).

Most successful brokers operate hybrid models, dynamically routing based on client profiles. General rule: profitable traders and large positions go A-Book. Small, statistically unprofitable accounts stay B-Book. Yes, this means betting against small retail clients. That’s the model.

What concerns us: misclassification risk. Systems must continuously reassess as client patterns evolve, but we’re not sure how much confidence to have in these dynamic reassessments. Are we detecting genuine pattern changes or responding to noise? Cost of misclassification can be substantial. Cost of over-conservative classification (everyone A-Book) eliminates B-Book profits entirely.

Client Segmentation for Forex Broker Risk Reduction

Statistical analysis reveals unprofitable trader traits: small deposits (under $1,000), excessive leverage (10x+ account risk per trade), no protective stops, short lifespans. Profitable traders show opposite patterns.

Automated profiling systems assign risk scores and route orders accordingly. Probably work better than manual classification, though marginal benefit versus implementation complexity varies by operation size.

Segmentation extends to identifying “toxic flow” – sophisticated traders or algorithms extracting profits through price inefficiencies or latency arbitrage. These clients get immediate A-Book routing or are asked to trade elsewhere. Happens more than you’d think.

Multi-Period Scoring Framework: What Actually Works

At YourFintech, we’ve developed a multi-period scoring system (0-100 scale) that evaluates trader behavior across four time windows: current session, 7-day, 30-day, and lifetime. This catches things that single-period analysis misses.

The core insight: A trader might look fine over 30 days but show toxic behavior in the current session. Or vice versa – a new account with limited history showing dangerous patterns that won’t be obvious until you zoom into session-level data.

The overall score formula we use:

Overall Score = (30-Day × 50%) + (7-Day × 30%) + (Session × Adjusted Weight)

Session weight adjusts by account age. New accounts (under 7 days) get session weight boosted +30% because you need to act on recent behavior when there’s no history. Accounts 7-30 days old get +15%. Older accounts use standard weights.

This framework catches toxic flow that traditional win/loss analysis misses. We’ve seen it identify latency arb traders after 8-12 trades instead of 50-100 trades. That difference is $10K-$30K in prevented losses per trader.

The system evaluates in real-time (every 30 minutes for session scoring) and daily recalculation for longer periods. You need this running continuously, not batch processing once a week. By then the damage is done.

Liquidity Provider Management

Single LP dependency creates concentration risk. Provider failures, technical issues, relationship terminations disrupt operations immediately.

Leading brokers maintain 3-5 LP relationships, distributing order flow based on pricing, execution quality, reliability. We’re uncertain about optimal number though. More providers means more diversification but also more operational complexity, more relationships to monitor, potentially worse pricing on individual relationships due to less concentrated volume. Probably an optimal point that varies by firm size, but we haven’t seen rigorous analysis of where that point is.

LP agreements should specify execution standards, pricing terms, credit limits, termination provisions. Regular performance monitoring ensures providers meet obligations.

Technology Infrastructure for Risk Management Automation

Modern forex broker risk management demands platforms processing thousands of trades per second with real-time risk calculations.

Automated controls: circuit breakers, position size limits, automated liquidation systems, kill switches. Our uncertainty is around optimal thresholds and parameters. Too conservative and you trigger false positives that disrupt operations. Too permissive and they don’t protect when needed. Finding right balance requires extensive testing and calibration, which most firms probably under-invest in.

Infrastructure must include backup systems, redundant data centers, disaster recovery capabilities. We’re skeptical about how thoroughly most firms test these under realistic failure conditions versus controlled scenarios. Testing is expensive and disruptive, creates incentives to test minimally.

Stress Testing in Forex Broker Risk Management

Stress testing simulates extreme market movements – flash crashes, central bank interventions, geopolitical shocks. Scenario analysis: largest LP fails, volatility doubles overnight, major clients simultaneously request maximum withdrawals.

Clearly valuable in principle. What we’re less certain about: whether typical stress testing captures scenarios that actually matter. We tend to test based on historical events (COVID-19, 2008, etc.) but future stress events probably won’t look exactly like past ones. Are we preparing for the last war instead of the next one?

Quarterly stress testing minimum, plus additional testing before major economic events. Though we wonder if cadence matters as much as quality and realism of scenarios tested.

Internal Controls and Governance

Trading desks shouldn’t supervise their own risk exposure. Independent risk teams report to senior management or boards.

Theoretically prevents conflicts of interest from compromising oversight. In practice, works well in larger organizations but creates bureaucratic friction in smaller operations where resources are limited. Benefit versus cost varies by firm size and organizational culture.

Dual-approval for high-risk activities. Large hedging transactions, significant LP credit increases, material margin changes need approval from both trading and risk. Does this prevent bad decisions or just create documentation trails? Both probably, though relative value of prevention versus documentation varies by organizational maturity.

30-60-90 Day Risk Management Implementation Roadmap

Implementation timelines are somewhat arbitrary. Speed depends on starting conditions, resources, organizational complexity. Some firms accomplish in 60 days what takes others 180 days (doesn’t necessarily mean one is better – might just face different circumstances).

Days 1-30: Assessment and Gap Analysis

Comprehensive risk assessment across all categories. Document current processes, technology, LP relationships, compliance status. Identify where exposure exceeds acceptable thresholds.

Challenge: defining “acceptable thresholds” requires judgment about risk tolerance that varies by firm. Probably no objectively correct answer, makes gap identification somewhat subjective despite appearing systematic.

Interview trading desk personnel, operations, compliance. People on the ground often know where problems exist before formal reporting shows them. Question is how to weight different perspectives when people disagree (and they will).

Benchmark against industry standards and competitors. Useful but potentially misleading if your model differs significantly from norms. Blindly copying competitor practices without understanding why they work for them can be counterproductive.

Days 31-60: Technology Selection and Initial Deployment

Evaluate platforms. Key criteria: real-time position aggregation, automated alerts, stress testing, regulatory reporting, integration with existing infrastructure.

Technology selection is challenging because vendors emphasize capabilities while downplaying limitations. Independent verification difficult without extended pilot testing, which delays implementation. You’re making decisions with incomplete information.

Implement high-priority controls first – position limits, margin monitoring, basic circuit breakers. Configure thresholds based on historical analysis and capital buffers (though historical analysis might not predict future volatility patterns and no way to know if you’ve calibrated correctly until actually tested under stress).

Establish additional LP relationships. Plan for 50-100% time overruns on integrations versus vendor estimates.

Days 61-90: Full Implementation and Testing

Roll out complete platform. Train personnel on systems, protocols, procedures. Training effectiveness hard to evaluate until personnel need to use knowledge under pressure (which hopefully doesn’t happen during implementation phase).

Run simulated stress scenarios. Simulations useful but inherently limited – real stress events include factors simulations don’t capture. How much confidence to place in simulation results?

Implement enhanced client segmentation and dynamic order routing. Monitor performance and refine parameters. Early performance might not reflect long-term behavior, so when do you stop refining and commit to specific parameters? Probably no clear answer.

Ongoing: Monitoring and Optimization

Quarterly stress testing and annual comprehensive assessments. Monitor regulatory developments, adjust proactively. Continuously refine client segmentation.

Regular audits verify controls function and personnel follow procedures. Audits valuable but costly and disruptive. How frequent is frequent enough? Probably varies by organizational maturity and recent incident history.

The Business Case for Professional Forex Risk Management

Professional risk management generates returns through reduced hedging costs, maximized B-Book profits with controlled market risk, operational efficiency from automation, reduced manual errors.

Whether benefits justify costs depends on circumstances. For larger operations, ROI seems clear. For smaller operations – costs don’t scale linearly downward, so smaller firms might face less favorable ratios.

ROI Analysis: Risk Management Investment vs Regulatory Penalties

Risk Management System Costs:

- Entry-level: $50K-$100K annually

- Mid-tier: $150K-$300K annually

- Enterprise: $500K+ annually

- Implementation consulting: $75K-$200K one-time

- Staff training/support: $50K-$100K annually

These figures are based on vendor quotes and industry reports. Actual costs might vary significantly based on specific requirements and negotiation outcomes.

Regulatory Penalties (2024-2025):

- NFA spread manipulation: $350K (single incident)

- AML deficiencies: $500K-$2M

- Fund segregation violations: $1M+

- Capital maintenance: License revocation + penalties

- Marketing violations: $100K-$500K

These are actual reported penalties, but the sample is limited. It’s unclear whether these represent typical enforcement outcomes or outliers that get publicized.

Operational Failure Costs:

- Platform outage: $50K-$500K per incident

- LP default: Variable, potentially substantial

- Fund theft/fraud: $500K+ average

- Unhedged market movement: Variable

The challenge with operational failure costs is that they vary enormously based on circumstances. Average figures might be misleading if the distribution is heavily skewed.

Break-Even Analysis:

A mid-tier solution costing $200K annually pays for itself by preventing a single moderate violation or operational failure. Most firms implementing comprehensive frameworks report ROI within 12-18 months.

Firms experiencing poor ROI might be less likely to report or participate in industry surveys, potentially skewing the data toward positive outcomes. The true ROI distribution might be wider than reported figures suggest.

The argument that “business continuity” is the real value rather than direct cost savings makes sense conceptually. Those 100 prop firms that collapsed in 2024 certainly would have benefited from better risk management. But we don’t know what proportion of operating firms face similar collapse risks versus what proportion are reasonably safe even without optimal risk management. The benefit of risk management depends partly on the baseline risk level, which varies across firms.

Competitive differentiation from reliable operations makes sense — clients value consistent execution, prompt withdrawals, stable margins. But how much of this differentiation translates to client acquisition and retention in practice? And does it vary by client segment? Institutional clients probably weigh operational reliability heavily, but do retail clients? We suspect the answer varies, which means ROI varies by business model.

Capital efficiency from sophisticated risk management — operating with lower buffers while maintaining equivalent safety — is theoretically appealing. But we are uncertain how many firms actually reduce their capital buffers in response to better risk management versus simply accepting improved safety at current capital levels. If firms don’t actually redeploy the capital efficiency into growth or returns, the benefit might not materialize.

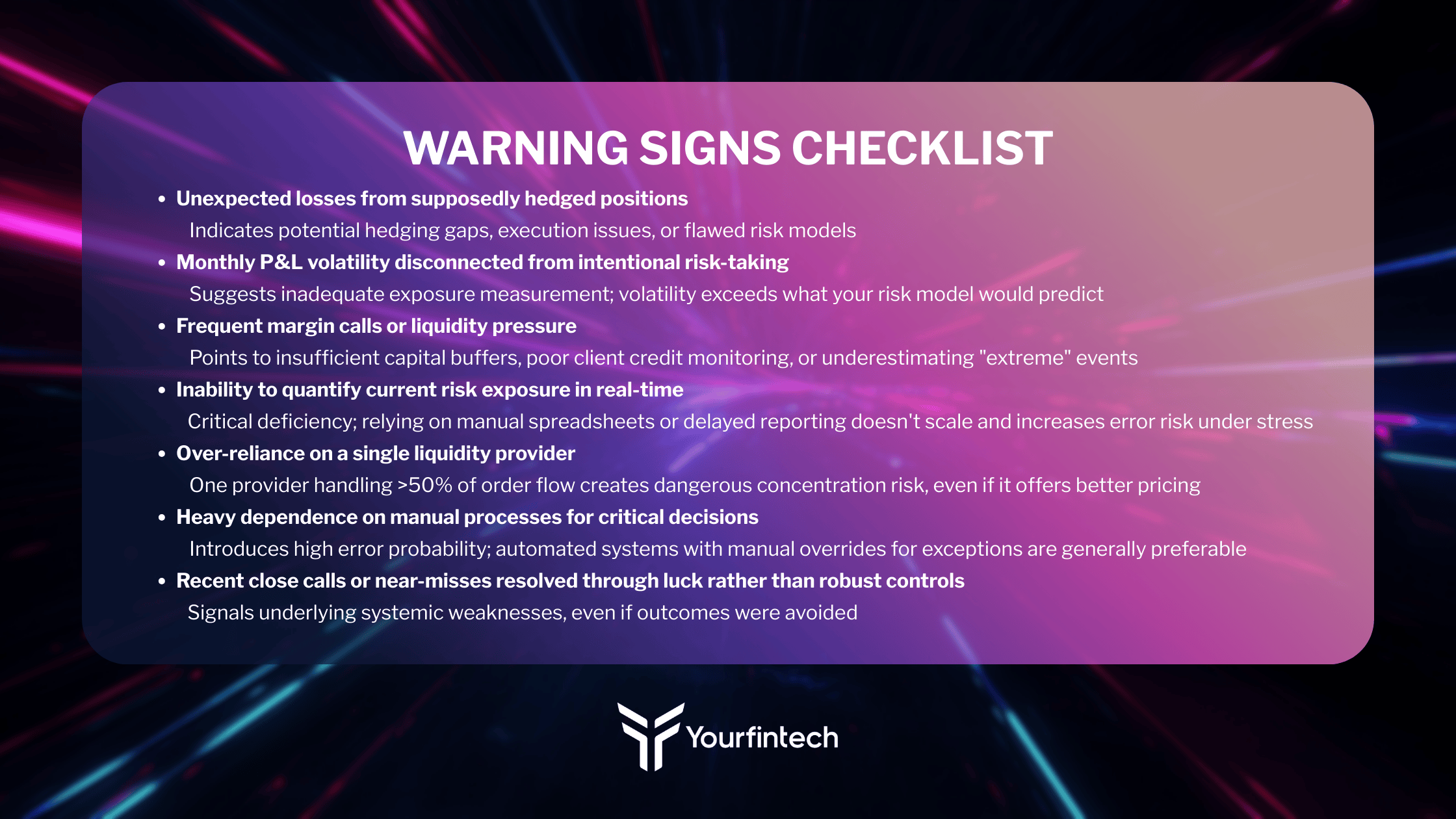

Warning Signs Your Broker Needs Enhanced Risk Management

Several indicators suggest immediate improvements needed (though relationship between warning signs and actual failure isn’t perfectly predictive – some firms exhibiting these persist for years, others without obvious signs fail suddenly).

Unexpected losses from hedged positions indicate gaps in hedging or execution. If monthly P&L volatility disconnects from intentional risk-taking, probably lack proper exposure measurement (though some volatility is inherent even with good controls – question is whether volatility exceeds what you’d expect given risk model).

Frequent margin calls or liquidity pressure suggests inadequate buffers or poor credit monitoring. Should rarely experience stress outside extreme events (but defining “extreme” is somewhat circular – if experiencing frequent stress, maybe what you thought were extreme events are more common than model assumed).

Inability to quantify risk exposure in real-time represents critical deficiency. Need accurate data within seconds. Manual spreadsheet monitoring might work for very small operations, doesn’t scale, introduces high error probability under stress.

Single LP dependency. If one provider represents over 50% of flow, face concentration risk (though concentration isn’t universally bad – might enable better pricing or relationship benefits – question is whether benefits justify risk).

Heavy reliance on manual processes introduces error probability. Automated systems with manual override only for exceptions clearly preferable (though automation creates own risks if systems malfunction, optimal balance varies by operational maturity).

Recent close calls or near-misses avoided through luck rather than controls might signal failure risk (though “luck” hard to distinguish from “good judgment” retrospectively – organizations rationalize both failures and successes in ways that make pattern identification difficult).

Conclusion

Risk management for forex brokers and proprietary trading firms functions as operational foundation supporting profitability – this much seems clear. Distinction between trader-side risk and protecting firm capital requires specialized expertise, sophisticated technology, continuous adaptation.

2024-2025 demonstrated firms prioritizing comprehensive forex broker risk management survive turbulence while competitors fail. Those 80-100 collapsed prop firms shared characteristics: inadequate capital planning, poor technology, insufficient monitoring.

What’s less clear to us at YourFintech: extent to which standardized best practices apply universally versus extent to which risk management needs customization to specific circumstances. Optimal approaches likely vary more than typically acknowledged. Industry tends to present risk management as if one framework fits all firms, but we suspect optimal approaches vary significantly.

Successful firms treat risk management as strategic investment rather than compliance burden. Real-time monitoring, dynamic margins, intelligent segmentation (with multi-period behavioral scoring, not just win/loss ratios), diversified LP relationships, robust technology combine creating operational resilience (though relative importance of these elements probably varies by circumstances in ways we haven’t fully characterized).

Regulatory scrutiny continues intensifying. Enforcement agencies deploying AI-driven monitoring and international cooperation. Proper forex broker risk management ensures obligations met while maintaining efficiency (though regulatory expectations continue evolving, creating moving targets firms must track).

For firms evaluating capabilities: Can you immediately quantify aggregate exposure? Respond effectively to sudden moves? Withstand largest counterparty’s failure? Can you identify toxic traders within their first 10-15 trades instead of their first 100? If uncertainty exists around these, infrastructure requires enhancement (though appropriate level depends on specific risk tolerance and business model).

Professional forex broker risk management services – like those YourFintech offers – provide expertise, technology, processes many firms can’t economically develop internally. External specialists bring experience across market cycles and access to institutional-grade systems (whether outsourcing makes sense versus building internal capabilities depends on firm size, complexity, growth trajectory – probably no universal answer).

Firms thriving in 2025 and beyond likely distinguish themselves through solid operational foundations built on comprehensive forex broker risk management frameworks rather than aggressive growth. Though we should acknowledge this might be survivorship bias – perhaps some aggressive-growth firms also thrive, we just notice ones with strong risk management because they’re more visible in industry discussions.

Price may attract initial clients. Only disciplined risk management sustains long-term success.