Articles

How Do Liquidity Providers Work? Guide for Forex Brokers and Prop Firms

Here’s something that still surprises us at YourFintech: brokers will spend months choosing a trading platform, weeks negotiating payment processor fees, and maybe an afternoon picking their liquidity providers. Then they wonder why execution quality is inconsistent.

Liquidity providers are the pricing infrastructure. Everything else — the slick UI, the client portal, the marketing — sits on top of what LPs actually deliver. When a price feed drops during NFP or spreads blow out during a flash crash, that’s an LP problem. When fill rates quietly deteriorate over six months, that’s usually an LP problem too.

We’re not saying LP selection is more important than platform choice. But it’s close. And it’s definitely not a box to check during launch week.

This guide covers how liquidity providers actually work (not the textbook version), the differences between tier 1 and prime of prime access, LP aggregation, and what to look for when you’re evaluating providers. We’ll skip the theory where we can.

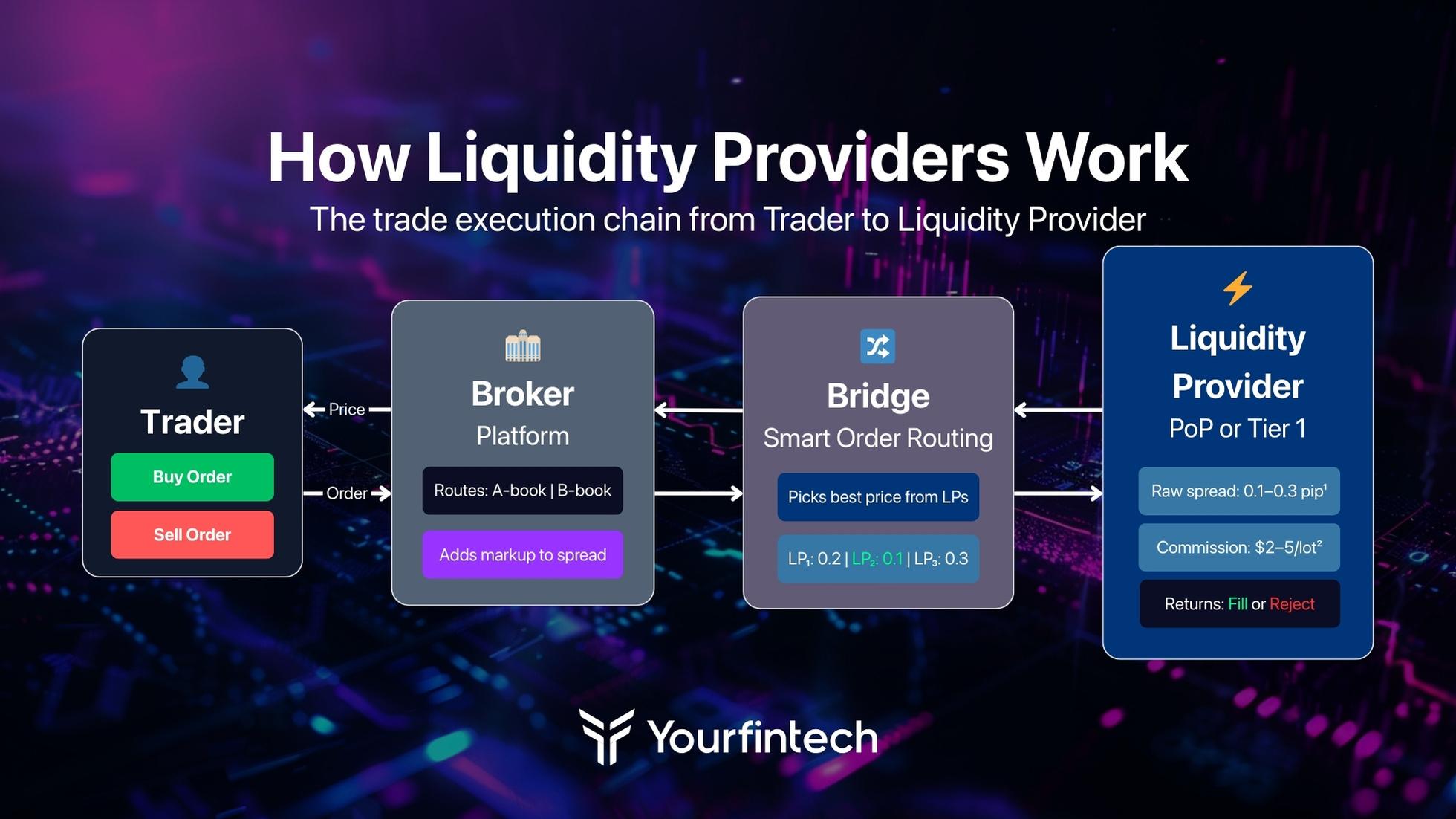

How Do Liquidity Providers Work? The Actual Mechanics

The basic pitch is simple: liquidity providers stream bid and ask prices, brokers hit those prices, trades get filled. A-book execution means the LP takes the other side. Done.

But the interesting part is how LPs make money, because it explains a lot of their behaviour.

Spread capture. That’s it. The gap between bid and ask, multiplied by enormous volume. We’re talking fractions of a pip per trade. The margins are brutal. An LP that can’t process millions of transactions with sophisticated automation and precise order routing won’t be around long. This isn’t a business where you can be “pretty good” at operations.

So what happens when your order hits?

LPs post two-sided quotes continuously. Your client’s order matches against available market depth — price-time priority, or smart order routing if you’ve got that set up. The LP fills from inventory or hedges externally. Trade settlement in milliseconds either way.

Here’s what most brokers don’t think about: LPs are constantly netting positions internally. They’re monitoring exposure across every instrument, offsetting opposing flow before hedging the residual. Good netting = lower hedging costs = better pricing for you. Bad netting = those costs show up somewhere.

One more thing. FIX protocol is still the standard for order routing. Fill-or-Kill, Immediate-or-Cancel — these matter for execution latency. REST and WebSocket APIs handle price feeds. Brokers sometimes treat connectivity as an afterthought, which is a mistake. The quoted spread is one thing. What you actually get filled at is another.

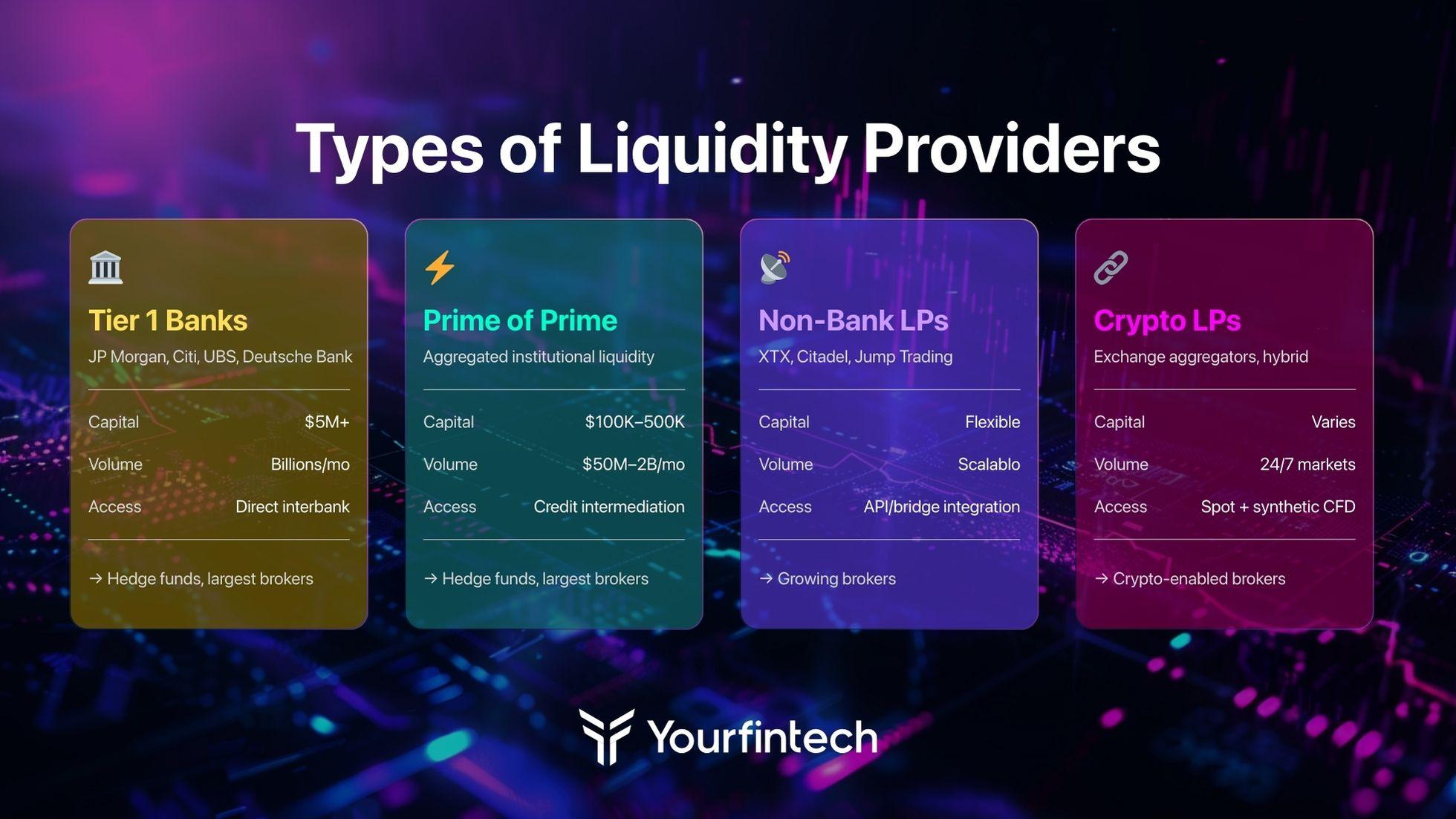

Types of Liquidity Providers

Not all LPs do the same thing. This matters when you’re figuring out how to choose a liquidity provider that fits what you’re actually building.

Tier 1 Liquidity Providers

JP Morgan, Citi, UBS, Deutsche Bank. The Bank for International Settlements says these institutions handle over 40% of daily forex turnover. Tight institutional pricing, massive depth, battle-tested infrastructure.

You probably can’t access them directly.

Tier 1 relationships require $5 million+ in capital, audited financials, and infrastructure that passes real due diligence. These exist for hedge funds and the largest brokerages. If you’re doing $200 million monthly, direct tier 1 access isn’t happening. And honestly? You probably don’t need it.

Non-Bank Liquidity Providers

This category barely existed fifteen years ago. Now it’s huge.

XTX Markets, Citadel Securities, Jump Trading — tech-driven firms that aggregate from tier 1 banks, ECNs, and internal pools, then redistribute through APIs and bridges. Faster onboarding than banks. Broader multi-asset liquidity. More flexible terms.

If you need forex liquidity infrastructure built this year, not in eighteen months after bank compliance finishes reviewing your application, non-bank providers are where you’re looking.

Prime of Prime Liquidity Providers

This is where most retail forex brokers and smaller prop trading firms actually live.

Prime of prime providers sit between tier 1 and everyone else. A prime of prime LP takes institutional liquidity from multiple upstream sources and packages it with credit intermediation, margin netting, and integrations for MT4/MT5, cTrader, FIX — whatever you’re running.

The numbers work for growing operations. PoP deposits run $100,000-500,000. Compare that to $5-20 million for direct tier 1. You get institutional pricing without locking up capital you need for growth.

People ask us about prime of prime vs tier 1 like one is objectively better. It’s not that simple. Which matches your volume? Your capitalisation? Do you need credit intermediation? Most brokers start with a PoP, outgrow it, negotiate better terms or add a direct relationship. Normal trajectory.

Crypto Liquidity Providers

Different animal.

Fragmented venues. 24/7 trading. Volatility that makes forex look boring. Crypto liquidity providers either handle these conditions or blow up. There’s not much middle ground.

You’ve got crypto-native aggregators pooling exchange feeds. Hybrid LPs mixing FX infrastructure with crypto pairs. Providers doing spot connectivity and synthetic CFD pricing. For prop trading firms and brokers adding digital assets, crypto liquidity provider selection comes down to venue coverage, how execution holds up during volatility, and whether the provider actually supports the instruments you want to offer. Great for BTC/USD doesn’t mean adequate for altcoin CFDs.

Broker vs Market Maker vs Liquidity Provider

These get mixed up constantly. It causes real confusion.

Brokers own the client relationship. Accept orders, route them — A-book externally, B-book internally. Revenue from spreads, commissions, whatever your model is. You control the interface and the client data.

Market makers take the other side as principal. Risk sits on their books. Profit from bid-ask capture and managing flow. If you’re running a B-book, you’re functioning as an internal market maker. That’s not a criticism — it’s a business model with specific characteristics.

Liquidity providers operate upstream. They supply executable pricing and market depth to brokers, not end users. Revenue from volume and micro-spread capture across massive transaction counts.

Brokers manage users. Market makers manage risk. Liquidity providers manage access. Different jobs, different incentives.

Liquidity Provider Pricing Models

Pricing structures vary more than people expect. Getting this wrong means your cost comparisons are meaningless.

Commission-based: Raw interbank spreads (0.0-0.2 pips on majors typically) plus per-lot commission, usually $2-5 round turn. Transparent. Works well if your clients are professionals who understand that “tight spreads + commission” often beats “zero commission + wide spreads.”

Markup-embedded: Everything bundled into wider spreads. Built-in markups of 0.5-1.5 pips, you add your retail layer on top. No commission on statements. Good for marketing “commission-free” to retail, even when total cost is the same or higher.

Revenue share: You get 30-70% of trading revenue from your flow. Sounds great. The problems live in the details. How is “revenue” calculated exactly? What’s classified as toxic flow and excluded? We’ve reviewed revenue share agreements where the fine print basically cancelled out the headline number. Read carefully.

Volume-tiered: Per-lot costs drop as volume increases. $3.50 up to $500 million monthly, $2.50 above a billion, etc. Creates incentives to concentrate volume with one provider, which might conflict with best execution if you’re routing for tier qualification instead of client outcomes.

LP Aggregation and Smart Order Routing

Single LP relationships are simpler. They’re also riskier and usually more expensive.

LP aggregation means combining price feeds from multiple liquidity sources into one pool. Tighter effective spreads, less counterparty concentration, continuity when an LP has problems. At YourFintech we consider this baseline for any broker doing real volume. Not advanced. Baseline.

The technical version: aggregation normalises feeds from multiple venues, presents best bid/ask. Smart order routing analyses depth across connected LPs and routes for optimal execution. Academic research — European equity and FX markets specifically — confirms SOR improves execution quality in fragmented environments. This is documented, not theoretical.

How it flows: client orders come in, match internally against opposing flow when possible, or go to the external pool. Orders bigger than internal depth route out automatically — primary LPs first, then secondary pools, ECNs. Fewer re-quotes, smoother pricing, scalable execution.

Getting aggregation right requires attention to things that aren’t obvious. Latency normalisation so faster feeds don’t win just because they’re fast. Fill-rate-weighted routing because an LP quoting aggressively but rejecting 40% of orders gives you worse execution than one with slightly wider spreads and 95% fills. Partial fill handling. Position reconciliation across counterparties.

Implementation usually means aggregation software — oneZero, PrimeXM, Gold-i. Budget $1,500-10,000 monthly depending on features and volume. Some platforms include basic aggregation, though dedicated solutions typically offer better routing logic.

How many LPs? Three to five provides diversification without management headaches. Below $200 million monthly, two or three usually works. Past five, the marginal improvement rarely justifies the overhead of more counterparty relationships, margin accounts, and reconciliation.

Why LP Quality Actually Matters

Everyone talks about spreads. That’s not the whole story.

Quality liquidity providers provide stability when things get ugly. LPs absorb one-sided pressure during macro shocks, smooth out price disruptions. Less gapping, less slippage, less erratic action — exactly when your margins and client experience are most vulnerable. NFP releases, central bank surprises, whatever’s happening geopolitically this week. Normal trading doesn’t test LP relationships. Chaos does.

There’s a compounding effect with forex liquidity depth. Traders who trust execution trade more, trade bigger. Consistent fills and visible market depth signal that a platform is healthy. Flow attracts flow. Churn decreases. Reputation builds among active traders (who talk to each other, by the way). For prop trading firms evaluating liquidity provider partnerships, execution quality metrics directly affect trader retention. Traders who don’t trust execution leave. Simple as that.

How to Choose a Liquidity Provider: What to Actually Evaluate

Gut feeling is not a methodology. Here’s what we recommend at YourFintech.

Pricing analysis — but not the marketing version. Get historical tick data. Thirty days minimum for your primary instruments. Calculate averages, but also look at 90th and 99th percentile distributions. Map time-of-day patterns. Most important: what does pricing look like during high-impact news?

Context: Finance Magnates Intelligence’s 2024 benchmark found top-tier LP EUR/USD spreads at 0.1-0.3 pips normally, widening to 1.5-4.0 during NFP. If an LP won’t share historical data that includes volatile periods, draw your own conclusions.

Execution quality — and actually measure it. Fill rates across order sizes (0.1 lots and 10 lots are different worlds). Slippage distributions — percentage filling at requested price, average slip on orders that move. Reject rates by reason. Real conditions, not demo account performance.

Depth of market transparency matters more as your client base matures. LPs exposing full order book depth enable better analytics and build trust with sophisticated traders who monitor this stuff.

Counterparty risk — people skip this until something explodes. Get audited financials if possible. Confirm regulatory authorisation (FCA, CySEC, ASIC). Understand margin segregation. What happens if the LP fails? The 2015 Swiss Franc event took down several PoPs. Brokers who hadn’t done counterparty due diligence scrambled for alternative liquidity sources in the middle of a crisis.

Operational support — more important than most pricing differences. Acuiti’s 2024 survey found 67% of broker executives ranked “responsive technical support” in their top three LP factors. Above spread tightness. Think about onboarding timelines, disaster recovery, escalation procedures. When something breaks at 3am, how fast can you reach someone who can fix it?

Conclusion

Liquidity providers aren’t vendors you set up and forget. They’re infrastructure partners whose capabilities shape what your brokerage can actually deliver.

What we covered: how liquidity providers work mechanically, the differences between tier 1 and prime of prime access, LP aggregation approaches, pricing models, evaluation criteria. The practical stuff.

If you’re running a single LP relationship, or you haven’t benchmarked execution quality in the past year, that’s where to start. Markets shift. LP pricing changes. Technology improves. We’ve seen brokers stick with arrangements that made sense at launch but became competitive disadvantages over time, just because nobody revisited them.

Liquidity infrastructure is strategic. Treat it that way.