Liquidity Bridge Technology: Connecting Your Broker to Multiple Providers

The forex market moves $9.6 trillion daily. That number from the Bank for International Settlements still catches us off guard sometimes — it’s roughly 25 times the daily volume of all global stock markets combined. At YourFintech, we’ve spent years helping brokers navigate this enormous flow, and one thing has become abundantly clear: the infrastructure sitting between your trading platform and the interbank market isn’t just plumbing. It’s the difference between a brokerage that scales and one that struggles with every volatility spike.

Liquidity bridge technology is that infrastructure. And honestly, the term undersells what modern bridges actually do.

Here’s the backstory that explains why bridges exist at all. When MetaQuotes built MT4, they designed it for a specific use case: brokers setting their own quotes and trading against clients. The platform was never meant to talk directly to banks or external liquidity providers. MetaQuotes didn’t implement the FIX protocol — the messaging standard that institutional markets have used since the early 1990s. So when brokers wanted to offer genuine market access while keeping the MT4 interface their clients loved, someone had to build a translator. That translator became the forex liquidity bridge.

Today’s bridge solutions have evolved far beyond simple protocol conversion. We’re talking about liquidity aggregation across dozens of providers, smart order routing that makes split-second venue decisions, real-time risk controls, and analytics dashboards that would’ve seemed like science fiction a decade ago. For brokers evaluating their execution infrastructure — or questioning whether their current setup is costing them clients — understanding what liquidity bridge technology actually does matters more than ever.

What Is a Liquidity Bridge? Core Functions and How It Actually Works

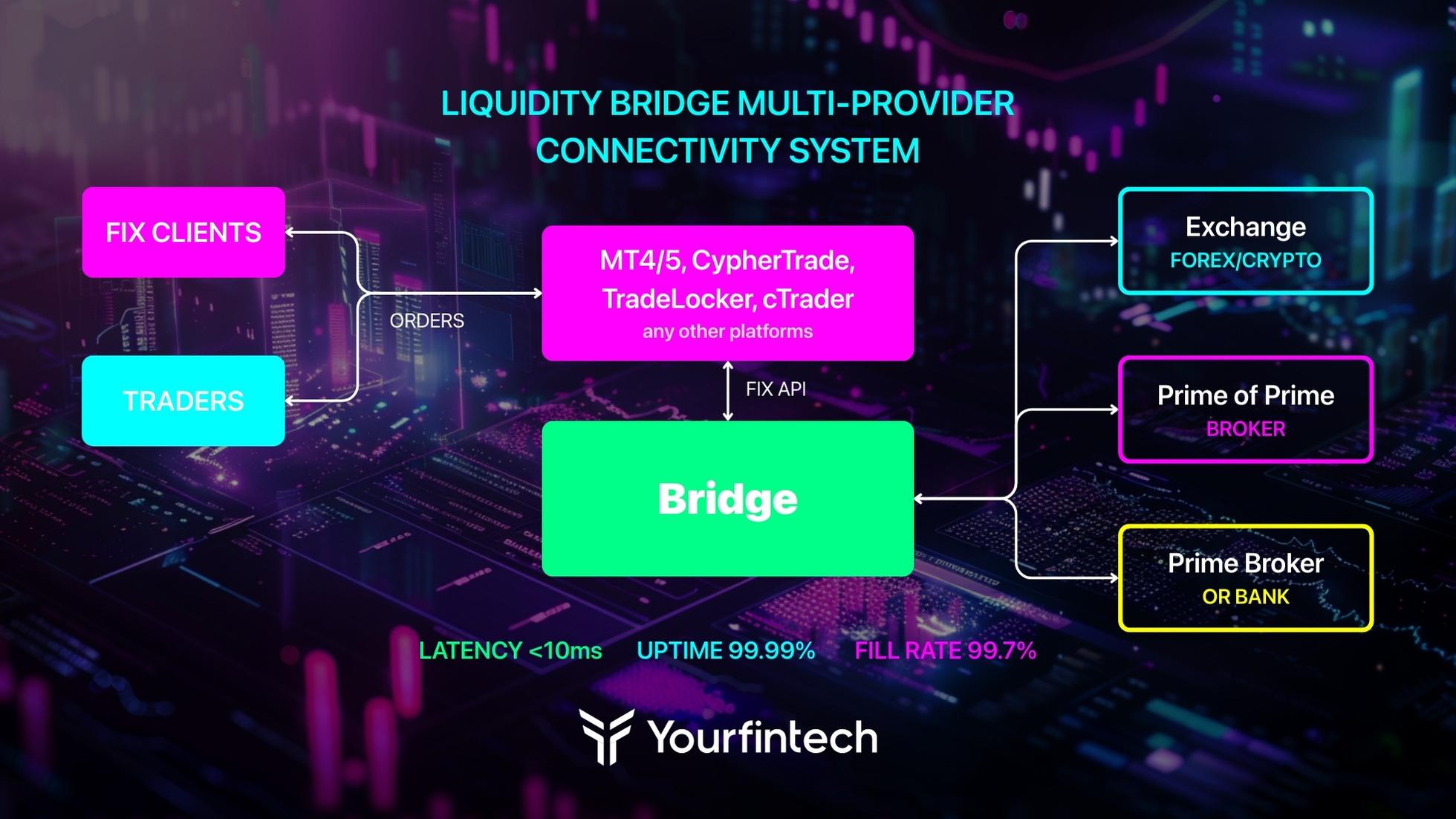

Let’s strip away the jargon for a moment. A liquidity bridge sits between your trading platform — whether that’s MT4, MT5, cTrader, CypherTrade or something proprietary — and the outside world of banks, non-bank market makers, and ECN venues. When a trader clicks “buy,” the bridge intercepts that order, figures out where to send it, and handles all the messy communication protocols that make the actual execution happen.

FIX Protocol: The Language Your Bridge Speaks

The technical side gets complicated fast. FIX protocol messages require precise formatting — session management, heartbeat monitoring, sequence numbers that can’t skip or repeat. Miss any of these details, and your orders get rejected. Or worse, your connection drops during a volatility event when you need it most.

We’ve seen brokers learn this lesson the hard way. One client came to us after their bridge vendor’s software failed to handle a sequence number reset properly. The result? Fifteen minutes of dead connectivity during an NFP release. Their clients were furious. The damage to their reputation took months to repair.

Enterprise-grade liquidity bridge technology manages multiple FIX sessions simultaneously — one for each liquidity provider, each with its own quirks and configuration requirements. Some LPs want specific message formats. Others have unusual heartbeat intervals. The bridge handles all of this invisibly, which is exactly how it should work.

Price Aggregation: Building a Better Order Book

Here’s where liquidity bridge technology starts delivering real value. Instead of showing your clients prices from a single liquidity provider, the bridge can aggregate quotes from five, ten, or twenty-plus sources simultaneously. It builds a composite order book, cherry-picking the best bid from one provider and the best ask from another.

The math works out beautifully. Say Provider A quotes EUR/USD at 1.0800/1.0802. Provider B comes in at 1.0801/1.0803. Your aggregated spread becomes 1.0801/1.0802 — tighter than either source alone. That improvement either flows to your clients as better pricing or stays with you as additional margin. Usually some combination of both.

At YourFintech, we’ve measured the impact across our client base. Brokers switching from single-LP setups to properly configured aggregation typically see spread improvements of 15-30% on major pairs. The numbers get even more dramatic on less liquid instruments where provider pricing varies significantly.

Price feed management sounds mundane until you consider the scale involved. During active London/New York overlap, a well-connected bridge might process 50,000 to 100,000+ price updates per second. Each update needs validation, normalization across different provider formats, and distribution to your platform — all with minimal latency. Fall behind on processing, and your quoted prices start lagging the market. Your clients notice. Your competitors don’t have the same problem.

The bridge also enforces your risk policies. Position limits, exposure caps, margin requirements — you can configure these at the bridge level as a safety net independent of whatever your platform does natively. For brokers running A-book execution models, this means clean pass-through with monitoring. For hybrid operations, the bridge decides in real-time which orders go to external liquidity providers and which get internalized based on your predefined rules.

Smart Order Routing: The Brain Behind Better Execution

If aggregation is about gathering quotes, smart order routing (SOR) is about making intelligent decisions with them. And this is where things get genuinely interesting.

How Routing Logic Actually Decides

When an order hits your bridge, the SOR algorithm evaluates available execution venues against whatever parameters you’ve configured. Price is the obvious one — send the order wherever offers the best quote right now. But sophisticated liquidity bridge technology goes deeper.

Latency-weighted routing factors in historical response times. Maybe Venue A shows a slightly better price, but Venue B consistently fills 8 milliseconds faster. During volatile conditions, those 8 milliseconds might mean the difference between getting your quoted price and eating slippage. Some brokers configure their routing to prefer speed over marginal price improvement. Others prioritize price above all else. There’s no universal right answer — it depends on your client mix and what they actually care about.

Volume-based routing tackles a different problem entirely. Large orders — say, a client wanting to execute 50 lots on EUR/USD — exceed the depth available at the best price. Rather than slamming the entire order into one venue and watching the price move against you, the SOR splits it. Ten lots here, fifteen there, spread across multiple providers or staggered over time. The client gets better average fill prices. You look like a hero.

Latency Numbers That Actually Matter

We need to talk about execution speed, because there’s a lot of marketing nonsense in this space.

Here’s what we see in real-world deployments: top-tier bridge solutions achieve internal routing decisions in sub-millisecond timeframes. The complete round-trip — order in, fill confirmation back — typically runs under 50 milliseconds in normal market conditions. Some providers claim execution latency below 3 milliseconds when colocated with LP infrastructure. Those numbers are achievable, but they require specific hosting arrangements and premium connectivity.

Does this matter for your brokerage? That depends entirely on who you’re serving. Retail traders placing a few trades per day won’t notice 50ms versus 20ms execution. But if you’re courting algorithmic traders, scalpers, or prop firms — and increasingly, brokers are — latency optimization isn’t optional. These clients measure your execution quality. They’ll leave if you’re consistently slower than alternatives.

We’ve helped brokers at YourFintech model this tradeoff. Sometimes the answer is “invest in colocation and premium connectivity.” Sometimes it’s “your current infrastructure is fine for your client base, don’t overspend.” The honest answer varies by situation.

Failover: What Happens When Things Break

Things break. LPs have outages. Network links go down. Someone at your data center trips over a power cable. (This has actually happened to a client. Twice.)

Robust liquidity bridge technology includes automatic failover logic. If your primary LP stops responding, the bridge reroutes to backup venues without waiting for human intervention. Your operations team gets alerted, but client orders keep flowing. This multi-LP connectivity redundancy is precisely why single-provider arrangements make us nervous. During market stress — exactly when you need execution capacity most — that’s when individual providers are most likely to struggle.

The more advanced bridge implementations are incorporating machine learning now. These systems analyze historical execution data — fills, rejects, slippage patterns, venue performance during different market conditions — and continuously refine routing decisions. It’s still early days for ML in this space, frankly. But the trajectory is clear: routing intelligence will increasingly differentiate bridge providers competing for broker business.

Why Multi-Provider Liquidity Aggregation Changes the Game

We’ve already touched on spread compression, but the benefits of connecting multiple liquidity providers through your bridge go beyond just tighter pricing. Let’s walk through what we consistently see across brokerages that make this transition.

Spread Compression and the Math Behind It

The aggregation math bears repeating because it’s so fundamental. Every additional LP you connect increases the probability that at least one of them is offering a competitive quote at any given moment. With ten providers, you’re not getting “average” pricing — you’re getting the best of ten quotes on the bid side and the best of ten on the ask side. The result compounds into meaningful spread reduction.

Brokers using liquidity bridge technology with proper multi-LP setups consistently price more competitively than single-source competitors. That translates directly into client acquisition and retention advantages. In a business where clients comparison-shop spreads before opening accounts, the edge matters.

Execution Reliability and the Redundancy Argument

Single-provider dependency is a risk we try to talk every client out of. Yes, it simplifies operations. Yes, you might negotiate slightly better commercial terms by concentrating volume. But you’re one outage away from disaster.

Remember March 2020? COVID volatility crushed liquidity provision capacity across the industry. Brokers with diversified LP relationships — even if some providers struggled — kept executing. Brokers dependent on single sources watched helplessly as their execution ground to a halt. Client trust evaporated in hours.

Diversification through multi-LP connectivity isn’t just about normal operations. It’s insurance for abnormal ones.

Expanding Your Product Range Without Compromising Quality

Different liquidity providers specialize in different things. Your best EUR/USD source might offer mediocre exotic pair liquidity. Your crypto CFD provider probably isn’t competitive on equity indices. By connecting multiple specialized sources through your forex liquidity bridge, you can offer comprehensive multi-asset trading without execution quality dropping off a cliff on instruments where your primary LP is weak.

We’ve seen brokers expand from pure forex into crypto, commodities, and equity CFDs specifically because their bridge infrastructure made it practical. The alternative — sourcing everything from a single prime of prime that’s mediocre across the board — leaves money on the table.

There’s a compliance angle too. MiFID II best execution requirements demand that brokers demonstrate they’re achieving good outcomes for clients. The detailed execution logs that bridge technology generates — every order, routing decision, fill price, timestamp — create the audit trail regulators expect. It’s not exactly thrilling stuff, but try explaining to your compliance officer why you can’t produce execution quality reports during an examination.

How to Choose a Liquidity Bridge Provider: What We’ve Learned

After helping dozens of brokers evaluate and implement bridge solutions, we’ve developed opinions about what actually matters in the selection process. Some of these might seem obvious. Others contradict what you’ll hear from vendors trying to close deals.

Platform Compatibility: The Non-Negotiable Starting Point

Your bridge has to work with your trading platform. Full stop. If you’re running MT4 bridge requirements, you need a vendor with proven MT4 integration. Same for MT5 bridge configurations, cTrader, or proprietary systems. This sounds obvious, but we’ve seen brokers get sold on impressive feature lists only to discover during implementation that the vendor’s MT4 support was buggy or incomplete.

Ask for references from clients running your specific platform. Talk to those references. Ask pointed questions about integration pain points.

Matching Latency Investment to Client Base

Here’s where we sometimes disagree with vendors pushing premium solutions. Not every broker needs sub-10ms execution paths. If your client base is primarily retail traders holding positions for hours or days, spending heavily on colocation and premium connectivity delivers minimal return. Your clients won’t notice or care.

But if you’re actively marketing to algo traders, scalpers, or prop firms — or planning to — latency optimization becomes genuinely important. These clients will benchmark your execution against competitors. They’ll find slow brokers and leave.

At YourFintech, we help brokers model this honestly. Sometimes the right answer is to invest heavily in speed. Sometimes it’s to save the money and compete on other dimensions. There’s no universal prescription.

Hosted vs. Self-Managed: The Trade-Off You’ll Face

Bridge vendors offer different deployment models, and the choice matters more than many brokers initially realize.

Hosted solutions mean the vendor manages servers, software updates, and connectivity monitoring. You get operational simplicity. You give up some control and potentially some customization flexibility. For smaller brokers or those without deep technical teams, this often makes sense.

Self-hosted deployments put you in control. You manage the hardware, network configuration, and ongoing maintenance. You will get maximum flexibility to customize and optimize. You also need staff who know what they’re doing, and the ongoing infrastructure investment is real.

Hybrid arrangements exist too — vendor provides the software, you manage the hardware. These can offer decent middle ground for brokers with some technical capability who want more control than pure hosting allows.

Liquidity Bridge Cost: Understanding Total Ownership

Vendor pricing models vary, and the sticker price rarely tells the whole story.

Setup fees typically range from $5,000 to $50,000+ depending on complexity and customization requirements. Monthly licensing might be flat-rate, volume-based, or tiered by feature set. Then add connectivity costs, hosting fees, and integration development if you need custom work.

We encourage brokers to model total cost over 24-36 months against projected order volumes. The cheapest option on paper sometimes becomes expensive at scale. The premium option sometimes delivers ROI through better execution quality and reduced slippage that outweighs the higher price tag. Do the math for your specific situation.

One more thing that doesn’t show up in feature comparisons: vendor stability. Your liquidity bridge technology sits at the absolute core of your execution infrastructure. If your vendor has financial troubles, gets acquired by a competitor, or simply provides inadequate support when something breaks at 3am on a Sunday — you have a problem that affects every client.

Ask how long they’ve been in business. Ask about client retention rates. Ask for references you can actually call. Check if they have proper support SLAs with response time commitments. These questions aren’t exciting, but they matter enormously over a multi-year relationship.

Wrapping Up: Where Does This Leave You?

Look, we’re obviously not neutral observers here. YourFintech has helped plenty of brokers navigate liquidity bridge technology decisions, and we think we do it well. But even setting aside our commercial interest, the underlying reality doesn’t change: the bridge layer between your platform and your liquidity providers shapes your execution quality, pricing competitiveness, and operational flexibility in ways that compound over time.

Brokers with properly configured multi-LP aggregation and smart order routing consistently outperform those with simpler setups. Not always dramatically — but enough to matter when clients compare spreads, when execution quality gets scrutinized, when volatility spikes and some brokers handle it gracefully while others struggle.

If you’re running legacy connectivity or stuck with a single liquidity provider, it’s probably worth evaluating modern alternatives. The technology has matured substantially over the past few years. What required custom development five years ago is often available off-the-shelf now.

And if you’re not sure where to start — or you want someone to pressure-test your current thinking — that’s exactly the kind of conversation we have at YourFintech. No obligation, no hard sell. Just an honest assessment of whether your bridge infrastructure is helping or hindering your growth.

The market isn’t getting any simpler. Your infrastructure might as well be an advantage rather than a liability.

Frequently Asked Questions About Liquidity Bridge Technology

What is a liquidity bridge in forex trading?

A liquidity bridge is middleware that connects your trading platform (MT4, MT5, cTrader, CypherTrade) to external liquidity providers. It translates orders from your platform’s native format into the FIX protocol messages that banks and LPs understand, enables price aggregation from multiple sources, and handles smart order routing decisions.

How much does liquidity bridge technology cost?

Costs vary significantly by vendor and deployment model. Typical setup fees range from $5,000 to $50,000+. Monthly licensing can be flat-rate ($1,000-$5,000+/month) or volume-based. Add connectivity, hosting, and any custom integration work for total ownership cost. We recommend modeling 24-36 month scenarios against your projected volumes.

Can I use a liquidity bridge with MT4?

Yes, MT4 bridge integration is one of the most common use cases. Most enterprise bridge vendors offer proven MT4 connectivity. The bridge compensates for MT4’s lack of native FIX protocol support, enabling you to connect to institutional liquidity while keeping the MT4 interface your clients expect.

What’s the difference between A-book and B-book execution with a bridge?

A-book execution passes client orders through the bridge to external liquidity providers — you earn on commission or spread markup without taking market risk. B-book execution internalizes orders within your own book. Modern bridges support hybrid models that route different orders to A-book or B-book based on configurable rules like trade size, client profile, or instrument type.