Articles

The Strategic Value of Consistency Rules in Prop Trading Evaluations

The Strategic Value of Consistency Rules in Prop Trading Evaluations

You’re a promising trader with a killer strategy, stellar technical analysis skills, and the confidence to take on the financial markets. You’ve just landed an interview with the best prop firm, but there’s one thing standing between you and that desired funded account: consistency rules that seem more like obstacles than opportunities.

But what if I told you these rules aren’t barriers at all? What if they’re actually the secret weapon that separates successful prop trading firms from the rest, and skilled traders from the gamblers?

Key Takeaways

- Consistency rules protect capital & filter skilled traders

- They prevent impulsive trading & improve risk management

- Firms with strong consistency metrics achieve better long-term returns

- Traders who master consistency unlock funding & growth

Why Consistency Rules Matter for Proprietary Trading Companies

Most prop trading firms are in the business of allocating their own capital, not client funds. Unlike brokerage firms or investment banks, a prop trading firm profits when its traders win, and bleeds when they don’t. This makes the firm’s ability to evaluate traders not just important, but existential.

Here’s where consistency rules come in.

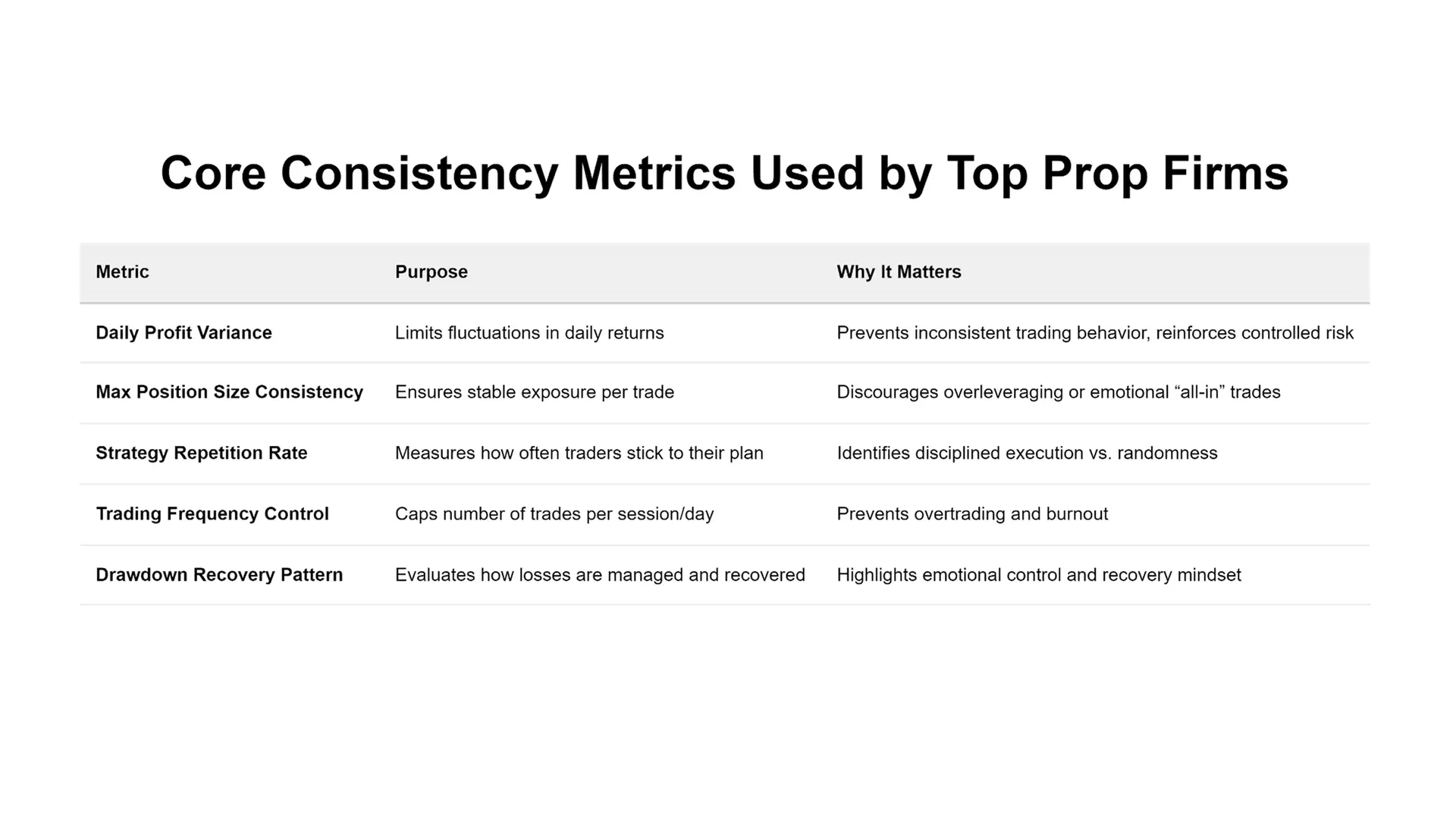

1. Risk Calibration: The First Line of Defense for a Prop Trading Firm

If a trader’s position sizes are all over the place or if their profits spike unpredictably, it’s a red flag. That behavior often signals emotional trading – chasing losses, overleveraging, or gambling on volatility.

By enforcing limits on:

- Daily profit variance

- Position size

- Strategy consistency

… Prop firms ensure that the trader’s style aligns with the firm’s overall risk management protocols. It’s not about limiting creativity; it’s about protecting the firm’s capital, especially in the prop firm business, where each trader directly affects the firm’s bottom line.

2. Model-Based Evaluation: Filter Out the Noise in Prop Firm

When traders are evaluated purely on P&L, it’s easy for randomness to skew judgment. But with structured consistency metrics, firms get a clearer picture:

- Is this trader using a repeatable strategy?

- Can their edge be scaled?

- Are their gains driven by skill or luck?

This is especially vital for financial firms investing in prop trading business, algorithmic trading, or deploying market data to support real-time risk monitoring. High-quality data leads to high-quality decision-making.

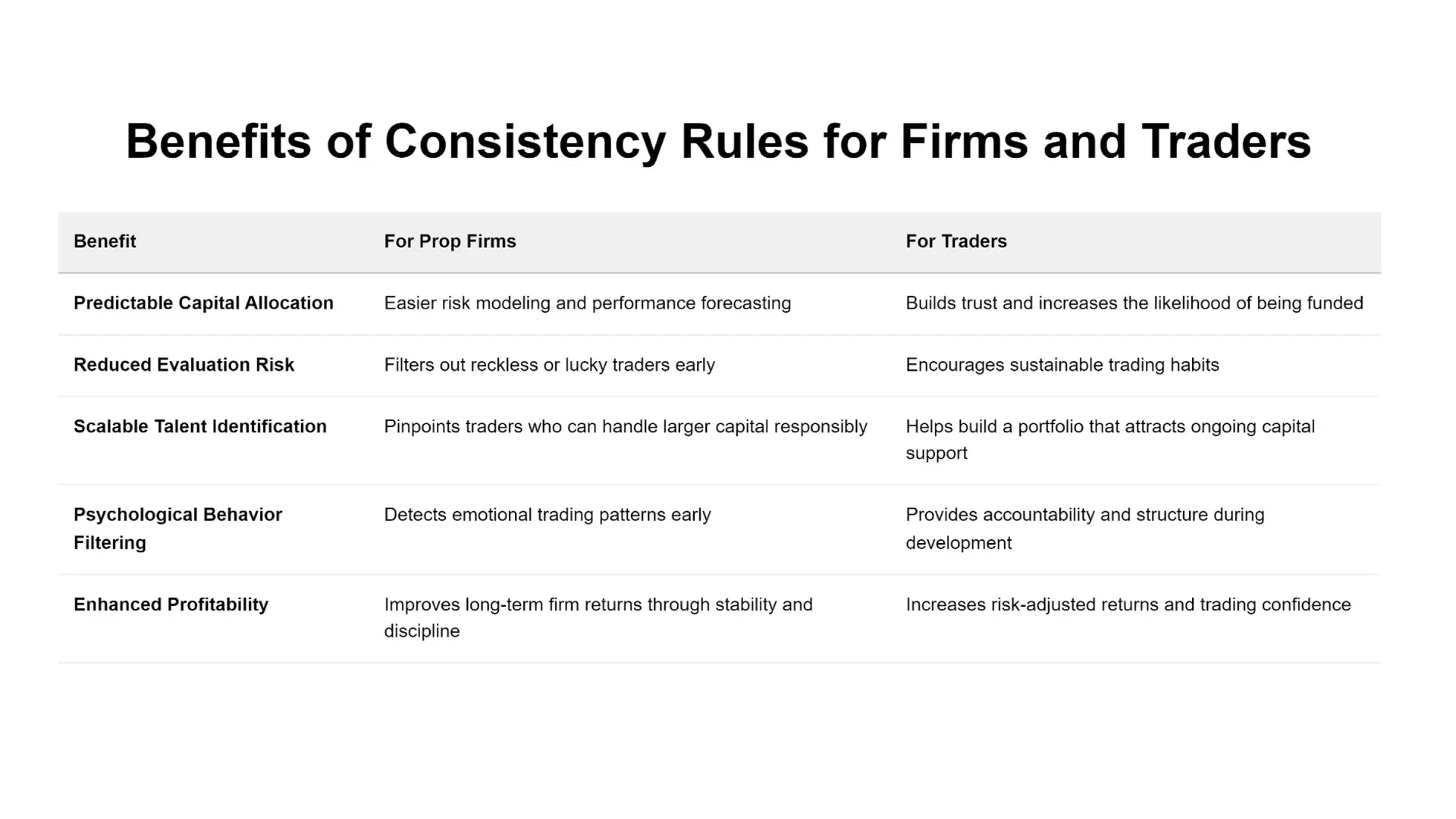

3. Trading Capital Efficiency: Scale the Right Traders

Funding a trader who wins big once and crashes later is expensive. And risky. Consistency rules act as a cost filter.

They help identify:

- Traders who scale predictably

- Traders with a track record of stable returns

- Traders who won’t burn through capital after one bad day

In other words, the rules allow the financial institution to allocate capital efficiently, boosting long-term firm profitability – an essential element when you open a prop trading firm or look to sell securities profitably.

4. Behavioral Filtering: Catch Problems Early

Ever noticed how some traders overtrade after a big win? Or double down after a bad loss? These behaviors are psychologically predictable and financially dangerous.

By analyzing consistency metrics, proprietary trading firms can spot these behaviors before real losses occur. It’s an early-stage behavioral filtering a psychological stop-loss.

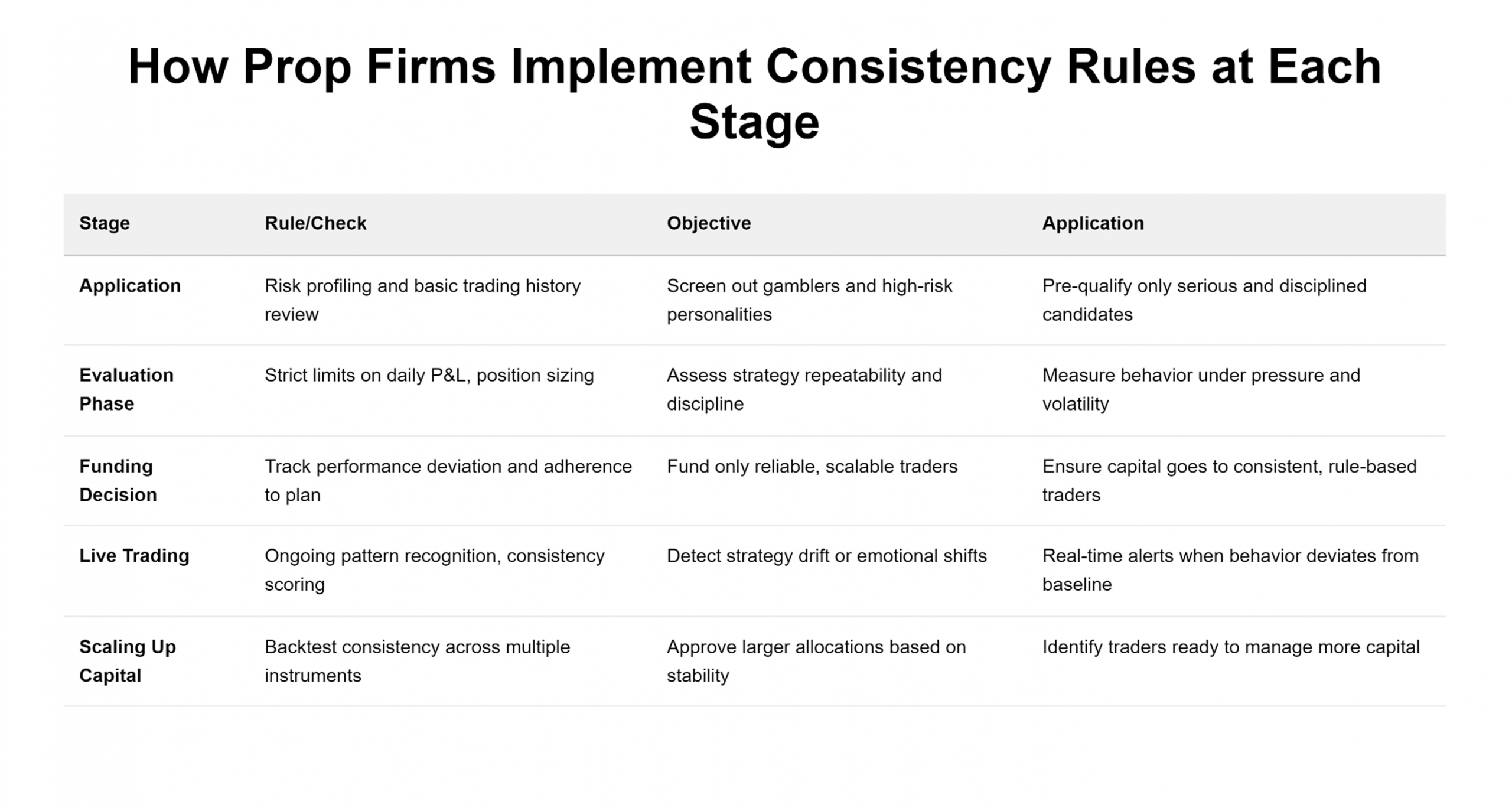

Why This Matters for Your Trading Career

If you’re preparing to start a prop trading firm, applying to one, or currently working through prop challenges, understanding this strategic framework changes everything. You’re not just trying to hit profit targets; you’re demonstrating that you possess the behavioral consistency that makes prop trading firms profitable.

Consider how this knowledge impacts your approach:

For New Traders: Instead of focusing solely on trading gains, develop a trading style that emphasizes consistent risk management and position sizing across all financial instruments you trade.

For Experienced Traders: Leverage your track record by highlighting not just your profits, but the consistency of your trading approach across different market conditions and timeframes.

For Algorithm Developers: Ensure your trading software incorporates consistency metrics that align with industry evaluation standards, giving you an edge in technical assessments.

The Bigger Picture: Strategy, Branding, and Survival in Financial Markets

As financial markets become more retail-accessible, prop challenges become marketing tools. Firms offer evaluations to attract professional traders and aspiring prop traders.

But behind the scenes, it’s not just about onboarding. It’s about screening. The evaluation process is the real battleground – one that separates scalable talent from speculative risk. A strong marketing strategy may bring traders to the door. But only careful planning, powered by consistency rules, determines who gets funded.

Whether you’re running a traditional firm or entering the market with a prop trading white label solution, your target market still expects strong infrastructure and predictable outcomes.

Real-Time Discipline in a Real-Time World

Top firms rely on real-time data, modern trading platforms, and cutting-edge trading software. But none of this matters if the traders behind the screens lack discipline.

Consistency rules connect:

- Market activity to human behavior

- Technology infrastructure to trader psychology

- Trading gains to long-term strategy

Whether you trade stocks, futures markets, or other instruments, consistency isn’t optional. It’s the hidden edge.

The Future of Prop Trading: Where Consistency Meets Innovation

As the prop firm business continues to evolve, with white label options making it easier than ever to open a prop trading firm, the importance of consistency rules will only grow.

The firms that understand this aren’t just building better evaluation processes – they’re creating sustainable competitive advantages. When you can predict trader behavior with greater accuracy, you can allocate capital more efficiently, manage risk more effectively, and ultimately deliver better returns to stakeholders.

This is particularly relevant as prop trading activities expand beyond traditional instruments to include cryptocurrencies, exotic derivatives, and emerging market opportunities. The more complex the trading environment becomes, the more valuable consistent behavioral patterns become as predictive indicators.

Predictive Power Drives Profit

The best proprietary trading firms don’t wait for a blow-up to fire a trader. They use consistency metrics to predict risk, plan capital allocation, and build teams of successful traders with a sustainable edge.

In a space that is heavily regulated, shaped by local regulations, and defined by intense competition, the strategic value of consistency rules in prop trading evaluations becomes a firm’s greatest asset.

So next time you’re navigating a prop trading interview or planning your trading goals, ask yourself: Am I trading for the long haul, or gambling with someone else’s money?

Your Next Steps: Turning Knowledge into Action

Understanding the strategic value of consistency rules isn’t just academic knowledge; it’s practical intelligence that can accelerate your trading career. Whether you’re targeting specific prop firms, developing your own trading strategy, or seeking to improve your current market performance, these insights provide a roadmap for sustainable success.

The key insight to remember: In short, consistency rules aren’t a barrier; they’re a predictive risk management tool.

As the industry grows, the firms that define and enforce these rules effectively will outperform not just in trader success rates, but in overall portfolio risk-adjusted returns. By aligning your trading approach with these strategic principles, you’re not just playing the game – you’re playing it at the highest level.

FAQs

1. What are the consistency rules in prop trading?

They are guidelines that enforce stability in trading behavior, such as limiting daily profit fluctuations, position size, or overtrading, to protect firm capital and identify skilled traders.

2. Why do proprietary trading firms use consistency rules?

To filter out impulsive traders, optimize capital allocation, and maintain profitability. They help firms identify traders with scalable strategies, not just lucky wins.

3. How do consistency rules affect trader evaluations?

They allow for a structured, model-based evaluation process that filters noise from real skill, reducing financial risk during the evaluation and funding phases.

4. How do proprietary trading firms differ from hedge funds or brokerage firms?

Prop firms trade with their own money, not client funds, and their traders operate using the firm’s capital. In contrast, hedge funds manage investor capital, and brokers earn on spreads or commissions.

5. Can consistent traders still lose money?

Yes. Even experienced traders face losses. But consistent behavior helps reduce those losses over time and ensures better risk-adjusted returns for the firm and trader.