Articles

Two Metrics Every Prop Firm Must Master

Two Metrics Every Prop Firm Must Master

What separates thriving prop trading firms from those that crumble under market pressure? It’s not just about recruiting the best prop traders or having the most advanced trading tools. The real secret lies in two critical financial metrics that most proprietary trading firms either ignore or misunderstand entirely.

So here’s the truth: If you run a prop trading firm or plan to launch one using a prop trading white label solution, mastering these two metrics is not optional. It’s essential.

Even the most elite proprietary trading firms can collapse if they mismanage two critical metrics:

- Net Operating Margin (NOM)

- Payout-to-Revenue Ratio

These numbers don’t just sit on a balance sheet – they determine whether your firm thrives or barely survives. Want to know how the top firms stay profitable while others fade away?

Key Takeaways

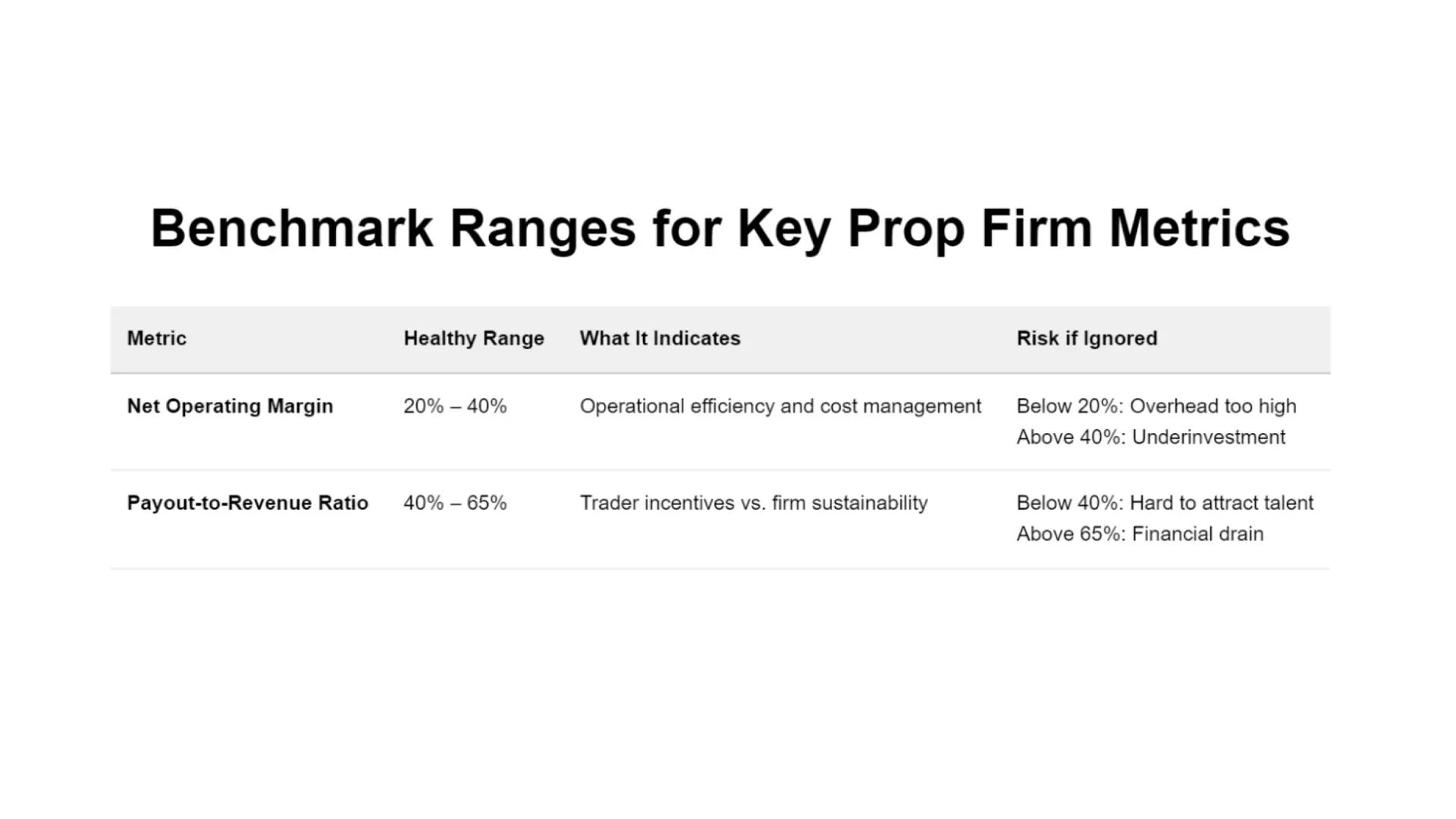

- Net Operating Margin (20–40%) reflects how efficiently your prop firm runs.

- Payout-to-Revenue Ratio (40–65%) ensures a balance between trader motivation and firm sustainability.

- Tracking both metrics together prevents long-term financial decay, even when short-term revenues look strong. Top firms align these metrics with profit sharing, trading rules, and risk management practices.

Net Operating Margin (NOM): The Lifeline of a Good Prop Firm

Imagine running a prop trading firm where revenue pours in, but expenses eat up 80% of it. Sounds stressful, right?

That’s where Net Operating Margin (NOM) comes in. It reveals how much of your revenue remains after operating expenses, and it’s arguably the most telling indicator of your firm’s operational health.

The healthy range for prop trading firms sits between 20-40%, but here’s what most firm owners don’t realize: this number tells four critical stories about your business:

- Reveals Operational Efficiency: A strong NOM means your firm runs lean, maximizing every dollar spent on trading tools, market making, or automated trading systems.

- Ensures Sustainable Scaling: Want to expand into futures markets or offer unlimited trading days? A healthy NOM gives you the financial cushion to grow without breaking the bank.

- Builds Confidence: Partners, investors, and even prop traders look for firms with a strong track record. A solid NOM signals you’re built to last.

- Buffers Downturns: Markets are unpredictable. A robust NOM acts as a shield, protecting your firm when trading activity dips or market conditions turn sour.

What happens if your NOM dips below 20%? You might be overspending on tech or hiring too many stock traders without enough revenue to justify it. On the other hand, a NOM above 40% could indicate that you’re underinvesting in trading platforms or advanced traders, thereby stifling growth.

Payout-to-Revenue Ratio: The Trader vs. Firm Balancing Act

Now, imagine your prop traders – futures traders, swing trading experts, or news trading pros – are raking in profits. You’re thrilled to share the wealth, but how much should you pay out?

Here comes in play the Payout-to-Revenue Ratio, which tells you how much of your revenue flows directly to traders, and getting this balance right is what separates sustainable prop firms from those destined to fail.

The sweet spot? 40–65%. Here’s why this metric is critical for proprietary trading firms:

- Balances Incentives and Sustainability: Generous profit splits attract top talent, but bloated payouts can drain your firm’s capital. A 40–65% range keeps traders motivated while ensuring funds for tech, risk management, and support teams.

- Supports Long-Term Growth: Retaining enough revenue allows you to invest in trading conditions, automated strategies, or even a prop trading white label to diversify income streams.

- Reduces Volatility Risks: Over-relying on challenge fees or volatile income can spell disaster. A balanced payout ratio ensures stability, even when market activities slow down.

What’s the risk of ignoring this metric? A payout ratio above 65% might thrill your funded traders, but starve your firm of resources for trading platforms or risk management. Too low, and you’ll struggle to attract experienced traders, leaving you stuck in the minor leagues.

The Power of Tracking NOM and Payout-to-Revenue Ratio Together

Think of NOM and Payout-to-Revenue Ratio as the yin and yang of prop trading. Track them together to avoid common pitfalls that sink even the most promising firms:

- High NOM but Bloated Payouts? You’re burning through long-term capital, risking your ability to fund new trading strategies or survive market downturns.

- Lean Payouts but Poor Margins? You might be overspending on trading tools or hiring too many staff, leaving little room for profit splits that attract top prop traders.

You can’t manage what you don’t measure, and when you measure, you see patterns that reveal weaknesses before they become crises.

Implementation: From Theory to Practice

So, how do you actually implement this knowledge? Start by conducting a comprehensive audit of your current financial position:

- Calculate your current Net Operating Margin by dividing your operating profit by total revenue. If you’re below 20%, you have an operational efficiency problem that needs immediate attention. If you’re above 40%, you might be missing growth opportunities or underinvesting in competitive advantages.

- Analyze your Payout-to-Revenue Ratio across different trader segments. Are you paying the same percentage to all traders regardless of their contribution to firm profitability? The most sophisticated prop firms use tiered structures that reward consistent performance while maintaining overall ratio health.

- Track these metrics monthly, not quarterly or annually. In the fast-moving world of proprietary trading, waiting too long for financial feedback can be fatal. Monthly tracking allows for quick adjustments and prevents small problems from becoming existential threats.

The best prop trading firms don’t just track these metrics; they build entire decision-making frameworks around them. Every major business decision, from hiring new traders to investing in trading tools, gets evaluated through the lens of its impact on both Net Operating Margin and Payout-to-Revenue Ratio.

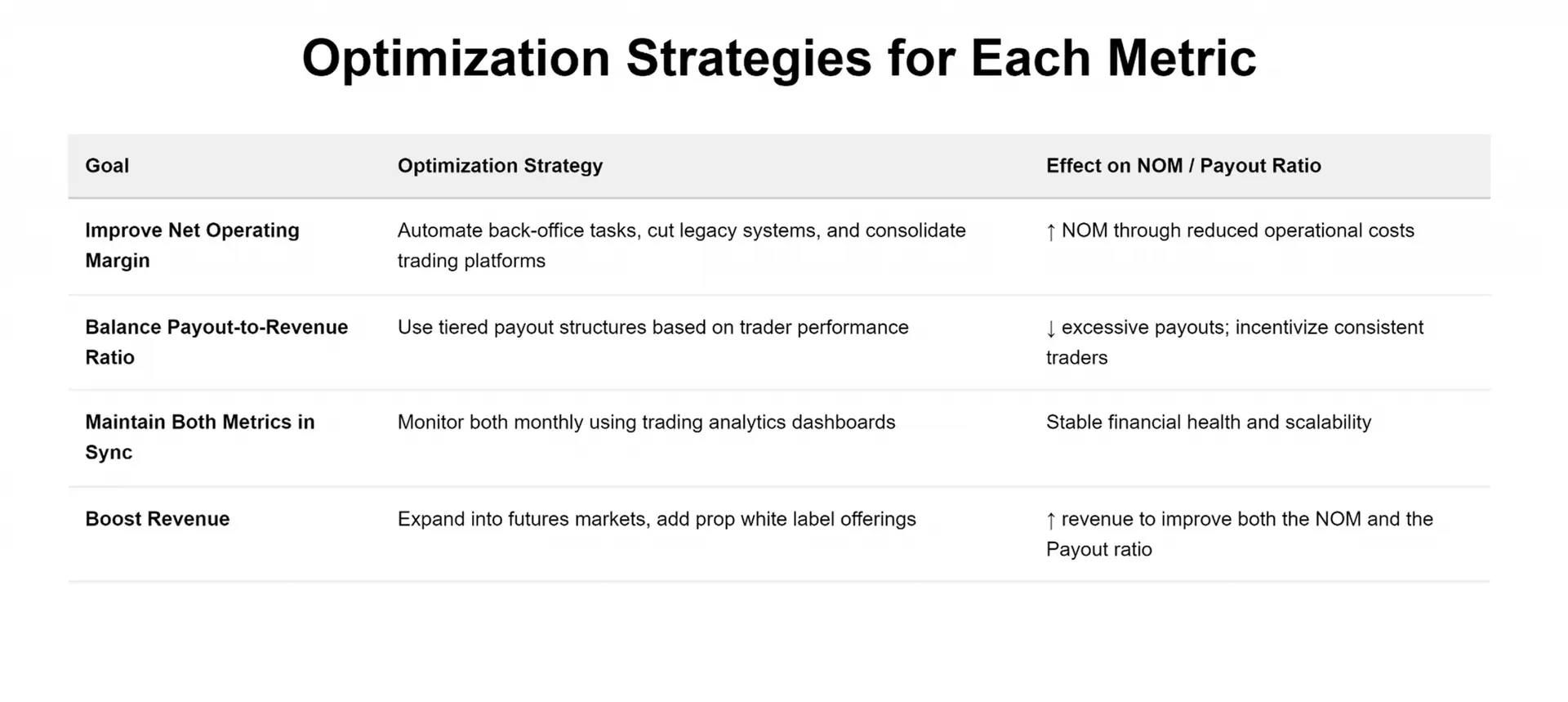

Here’s how to optimize NOM and Payout-to-Revenue Ratio:

- Streamline Operations: Cut unnecessary costs without compromising trading platforms or risk management. For example, invest in automated trading tools that reduce manual overhead.

- Set Clear Profit Targets: Design trading rules with minimum trading days and achievable goals to ensure funded traders contribute to revenue without excessive payouts.

- Diversify Income Streams: Offer a prop trading white label or expand into precious metals and futures markets to reduce reliance on challenge fees.

- Invest in Talent and Tech: Attract advanced traders with competitive profit sharing and equip them with cutting-edge trading platforms to boost revenue, improving both NOM and payout ratios.

- Monitor Regularly: Use advanced trading tools to track these metrics in real-time, ensuring you stay within the 20–40% NOM and 40–65% payout ranges.

Instead of discovering problems after they’ve already damaged your firm, you identify and address issues while they’re still manageable.

Final Thought: Metrics That Build Legacies

Proprietary trading isn’t just about flash and speed. It’s about clarity, consistency, and resilience. The difference between a struggling prop firm and a market leader boils down to financial discipline.

- Are you monitoring your NOM and payout ratio?

- Is your firm built to last, or just to cash in short-term?

If you’re serious about long-term success, start optimizing these metrics today. Your traders focus on beating the markets. Your job is to build a firm that can support their success for years to come. These two metrics are your roadmap to getting there.

Want more insights on running a top-tier prop trading firm? Stay tuned – we’ll break down more strategies that separate the best from the rest.

FAQs

- What financial instruments do proprietary trading firms typically offer access to?

Proprietary trading firms give traders access to a wide range of financial instruments, including stocks, forex, commodities, indices, and futures contracts. Many futures prop firms specialize in derivatives and provide tools for trading global markets efficiently.

- What is a futures prop trading account?

A futures prop trading account lets traders use the firm’s capital to trade futures, no need to risk their own capital, but performance rules apply.

- Do prop firms manage client funds like hedge funds or investment banks?

No, unlike hedge funds or investment banks, prop firms trade with their own trading capital, not client funds, making them more agile and trader-focused.

- What makes the best futures prop firm stand out?

The best futures prop firm offers fair payouts, strong tech, flexible trading styles, and supports successful traders with tools and risk controls.

- What do prop trading interviews focus on?

Prop trading interviews assess strategy, risk mindset, and adaptability across various trading styles, not just experience.

- Can prop firms sell securities or act as financial institutions?

Most don’t sell securities or act as a full financial institution. They focus on enabling traders to trade using firm capital under set rules.