Articles

Trader Segmentation & Risk Triggers – A Quick Breakdown

Trader Segmentation & Risk Triggers – A Quick Breakdown

Do you really know what’s driving your brokerage’s revenue and what’s threatening it? Are your most active traders actually your biggest risk exposure?

Every day, brokers face a fundamental challenge: distinguishing between traders who generate sustainable revenue and those who pose hidden threats to their operations. The question isn’t whether you should segment your traders, but rather: can you afford not to? In today’s volatile market conditions, where algorithmic trading and high-frequency transactions dominate, the ability to quickly identify and manage risk exposure has become the difference between thriving and merely surviving.

But what exactly is trader segmentation, and why does it matter? How can you use it to manage risk, optimize profits, and stay ahead in the ever-changing financial markets? Let’s break down how behavior types, revenue patterns, and risk triggers interact and how you can make more informed decisions while avoiding potential losses.

Key Takeaways

- Segmenting trader behavior helps uncover hidden risk triggers and revenue leaks.

- Not all volume is profitable; spread-to-profit ratios tell a deeper story.

- Monitor external factors like volatility, latency, and coordination patterns.

- Use segmentation data to shape strategy, manage exposure, and stay ahead.

The Hidden Truth About Trader Revenue and Risk Management

Picture this scenario: Your books show healthy revenue numbers, but something feels off. One segment is outperforming expectations by 50%, while another consistently falls short. Are these normal market movements, or are you missing critical warning signs?

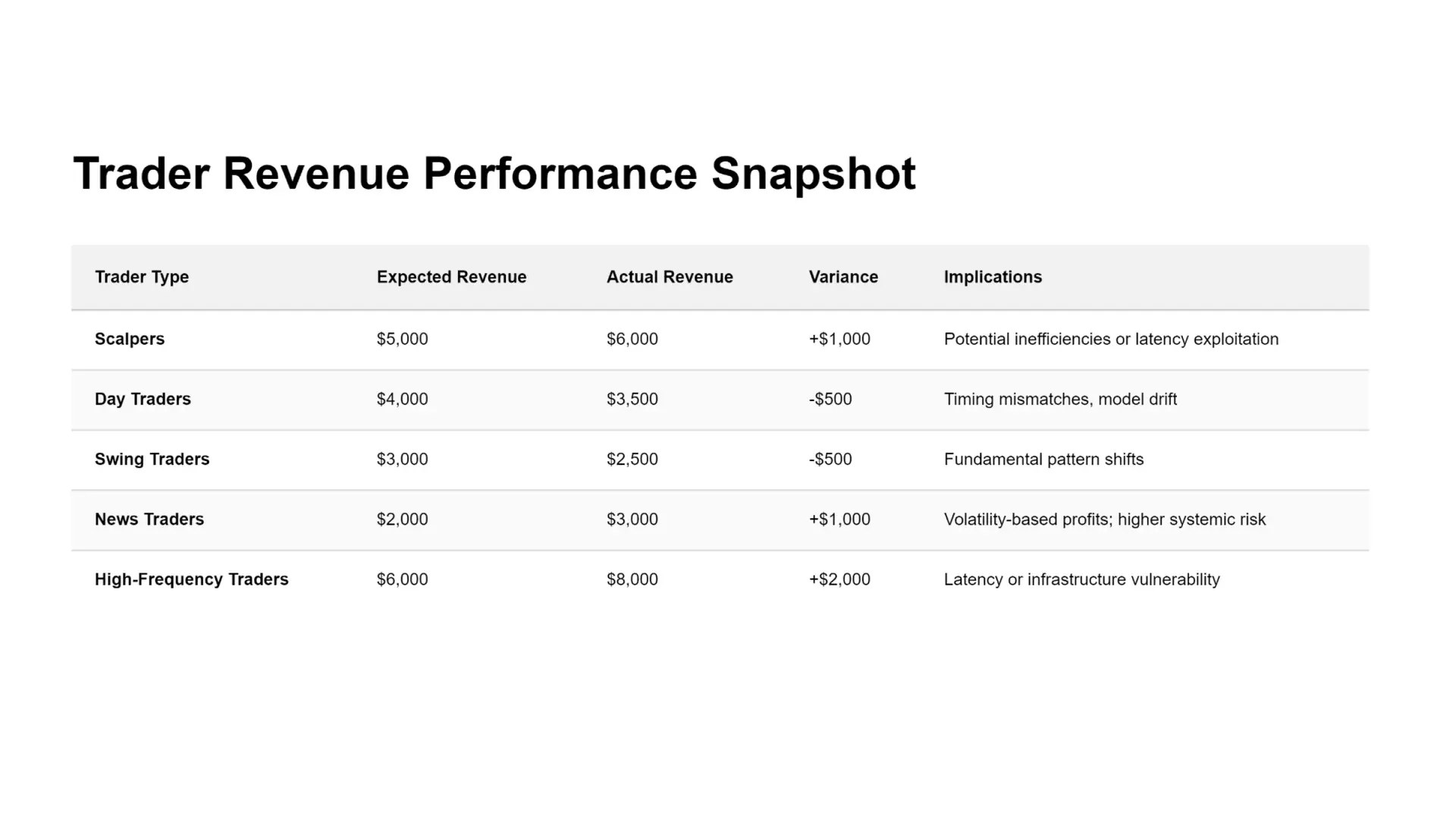

This is exactly why brokers use sophisticated trader segmentation strategies. By categorizing traders into distinct groups – scalpers, swing traders, high-frequency traders (HFTs), news traders, and others – financial institutions can compare expected versus actual revenue performance. This comparison reveals far more than simple profit margins; it exposes operational risk, market risk, and potential execution gaps that could cost millions.

Consider the real-world performance data:

- Scalpers recently delivered $6,000 against an expected $5,000, representing a $1,000 overperformance. While this might seem positive, it raises questions: Are they exploiting short-term market inefficiencies that your risk management models haven’t accounted for?

- Day Traders showed concerning underperformance, generating only $3,500 versus the expected $4,000 – a $500 shortfall that suggests possible timing mismatches or model drift in your pricing algorithms.

- Swing Traders similarly lagged expectations with $2,500 actual versus $3,000 projected, another $500 gap that demands investigation into whether prevailing market conditions have shifted fundamental trading patterns.

But here’s where it gets interesting: News Traders dramatically outperformed, bringing in $3,000 against a modest $2,000 expectation. This $1,000 surplus indicates they’re successfully capitalizing on increased volatility events, but are your systems prepared for the increased risk exposure this creates?

The most striking performance came from High-Frequency Traders, who generated $8,000 versus an expected $6,000 – a substantial $2,000 overperformance. This 33% beat rate might look like a windfall, but experienced risk managers know better. Such dramatic outperformance often signals latency exposure issues or fundamental flaws in model assumptions.

Why should this concern you? HFT strategies rely on sub-second burst trades and split-second market movements. When they consistently outperform expectations, it suggests they may have latency advantages that your risk models haven’t properly factored in. This scenario has historically led to substantial losses for unprepared brokers.

These gaps tell brokers where to dig deeper, whether to adjust risk models, fix execution flaws, or even limit exposure to certain trading styles.

Trader Behavior Types: Who’s Who in the Stock Market?

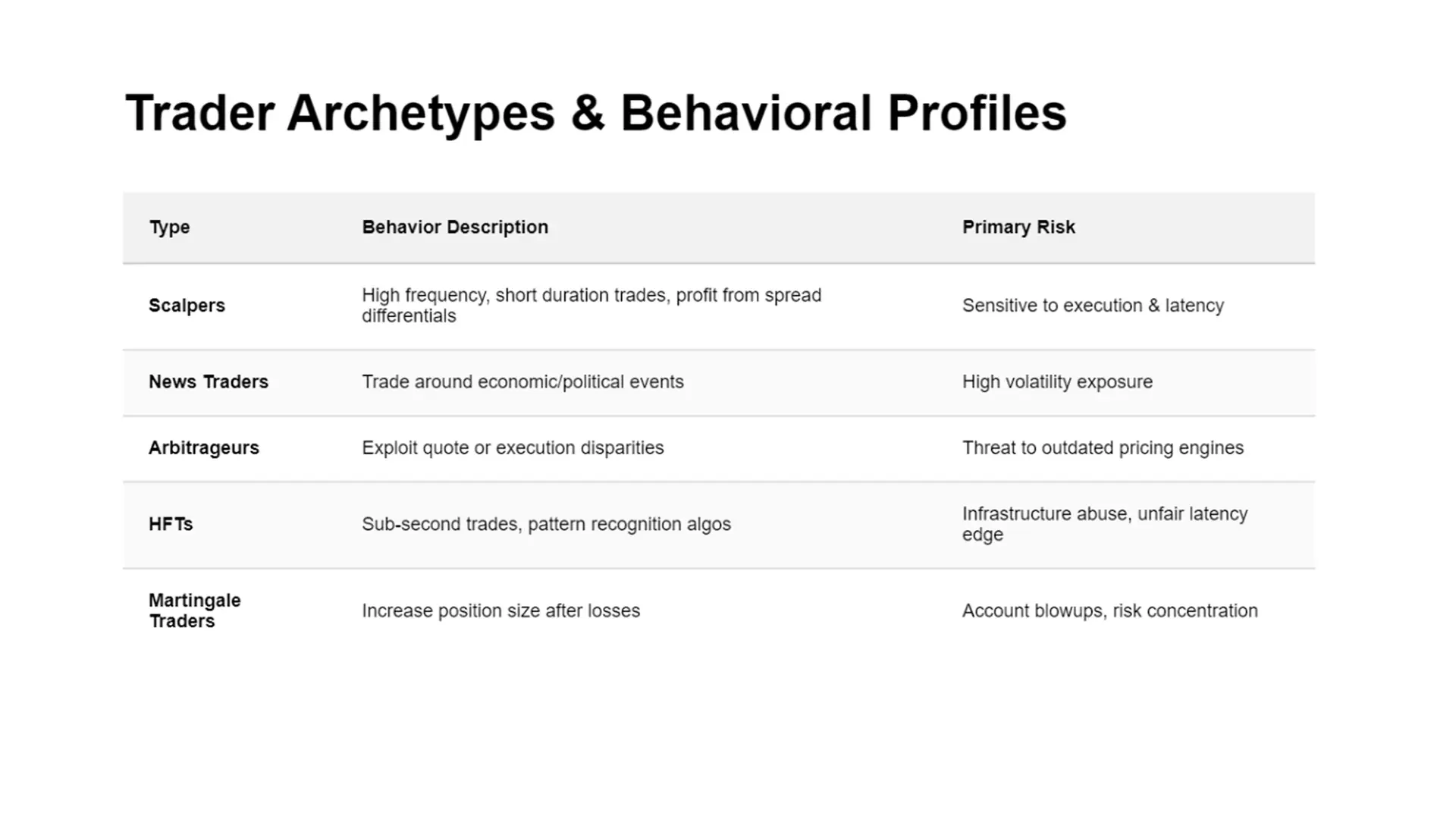

Every trader has a unique fingerprint in the market, shaped by their trading strategy and risk appetite. Understanding the five most common trader behavior patterns is crucial for effective risk management:

- Scalpers operate with high frequency and quick exits, often holding positions for mere seconds. Their success vary depending on exploiting tiny price fluctuations across different markets, making them particularly sensitive to execution speed and spread efficiency.

- News Traders create dramatic spikes around economic announcements and geopolitical events. They thrive on economic uncertainty and political instability, various factors that can influence prices in unpredictable ways.

- Arbitrageurs capitalize on stale quotes and pricing discrepancies across various trading platforms. They’re essentially hunting for market inefficiencies, which makes them both profitable and potentially dangerous to brokers with outdated pricing models.

- HFTs execute sub-second burst trades using sophisticated algorithmic trading systems. They’re looking for patterns in supply and demand dynamics that human traders simply cannot detect or act upon quickly enough.

- Martingale Traders employ the risky strategy of increasing lot sizes after losses, hoping to recover with a single profitable trade. This approach can lead to catastrophic losses during prolonged unfavorable market conditions.

Behavior detection relies on analyzing trade count, duration, and volume patterns, but the real skill lies in interpreting what these patterns mean for your business.

Spread vs. Profit Efficiency: Not All Volume Is Equal

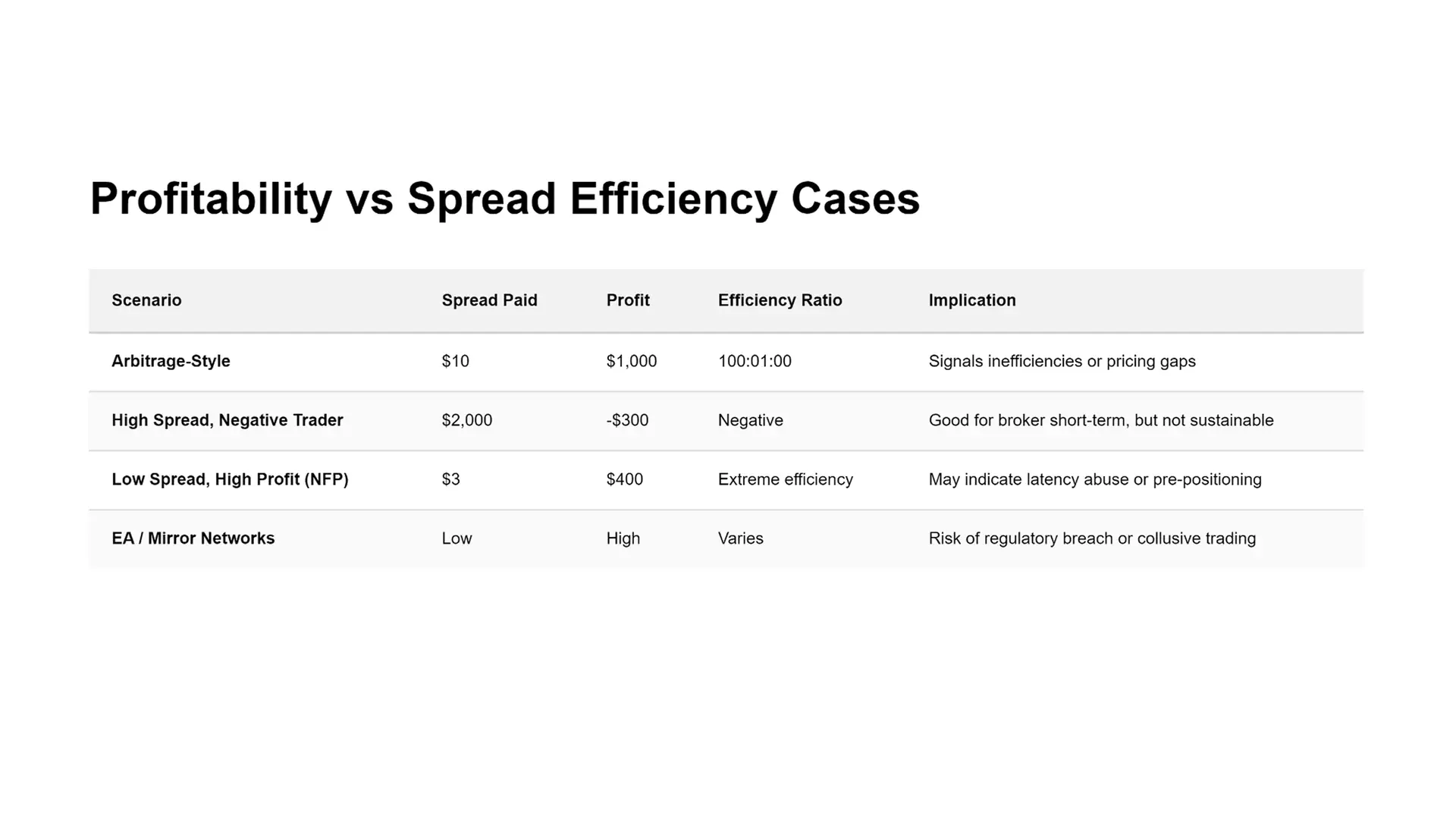

Volume alone doesn’t tell the story. Some traders lose money but still pay large spreads, boosting broker revenue. Others make a killing on thin spreads, revealing a potential exploit. Both scenarios affect broker performance differently and require distinct risk management approaches.

Consider these real examples that illustrate the complexity:

- A trader achieving a $10 spread with $1,000 profit creates a 100:1 ratio – an extraordinary efficiency that suggests possible arbitrage opportunities or flawed execution exposure on your end.

- Conversely, a trader paying $2,000 in spread while suffering a $300 loss represents a different kind of challenge. The broker earns revenue, but the trader lacks a sustainable edge, potentially leading to account closure and lost future revenue.

- Perhaps most intriguing is the trader who pays only $3 in spread while earning $400 profit during Non-Farm Payroll (NFP) announcements. This scenario typically indicates latency advantages or pre-positioning strategies that could signal insider information or unfair trading practices.

- EA (Expert Advisor) networks showing low spread with high profits often involve mirror trading or latency hedging – sophisticated strategies that can create significant regulatory risk and compliance challenges.

Each scenario has implications for your financial system. The wrong behavior in the wrong market could amplify external factors like geopolitical events, natural disasters, or political instability, increasing your risk exposure.

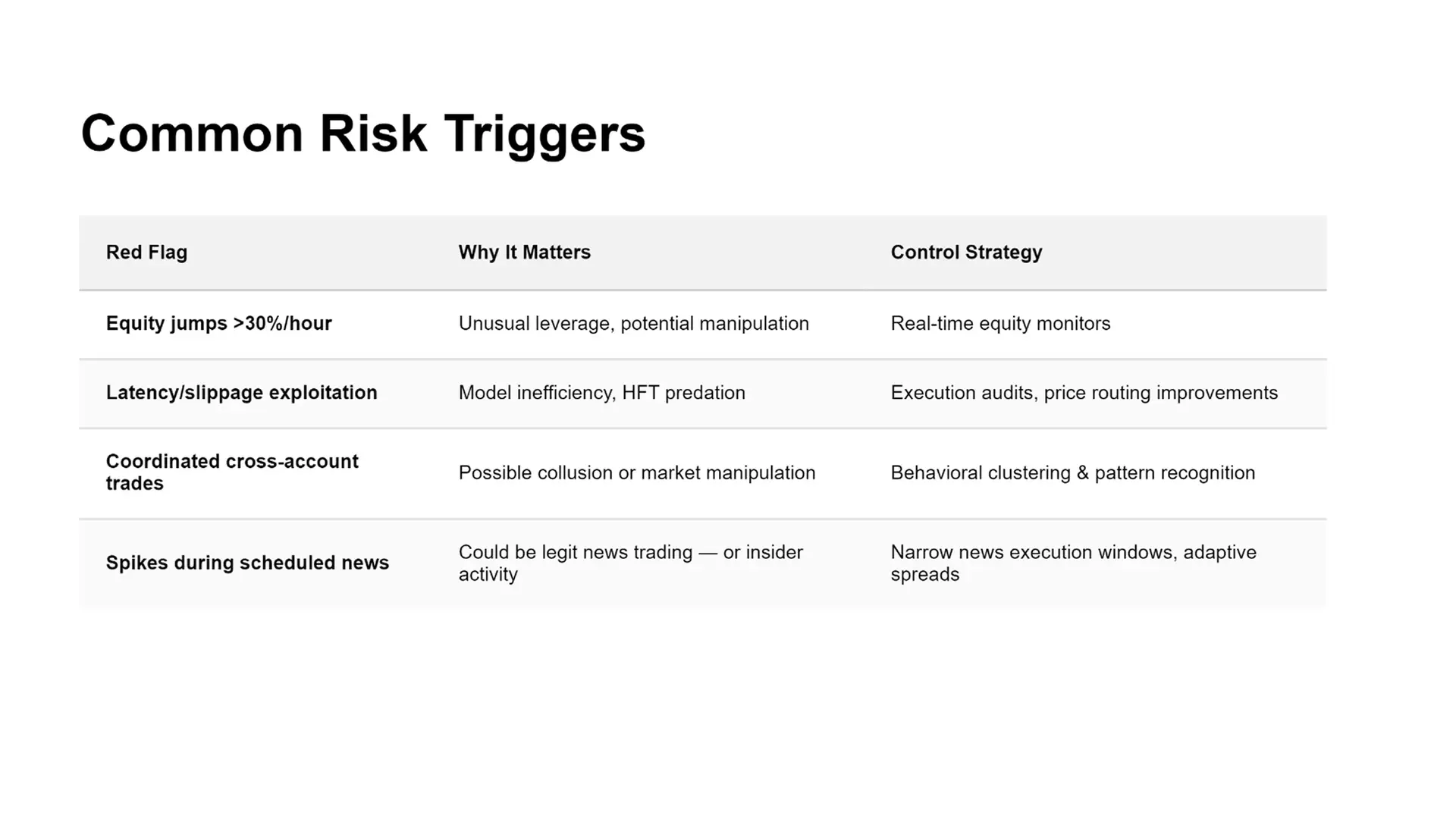

Red Flags: Risk Triggers You Can’t Ignore

Increased trader profitability isn’t always a good thing. Look deeper when you see these risk triggers:

- Equity jumps exceeding 30% per hour often indicate unusual market exposure or potential system manipulation. In today’s interconnected financial system, such dramatic movements can cascade across multiple positions and accounts.

- Latency and slippage abuse represent a growing concern as traders develop increasingly sophisticated methods to exploit timing advantages. This is particularly relevant given the rise of algorithmic trading and high-frequency strategies.

- Coordinated trades across multiple accounts may signal organized attempts to manipulate market conditions or circumvent position limits. Such coordination can affect entire sectors and create systemic risks.

- Trading spikes during news releases require careful monitoring because they can indicate either legitimate news trading or potential insider information usage.

Left unchecked, these behaviors could lead to substantial losses across a single asset, a particular sector, or even your entire portfolio.

Strategies to Mitigate Risks: Practical Tips

To manage your exposure and navigate changing market conditions, implement these safeguards:

- Monitor demand dynamics – Watch how supply and demand dynamics shift under pressure.

- Build contingency plans – Prepare for economic uncertainty and market disruptions.

- Avoid over-reliance on one company or trader type – Diversify across different markets and securities.

- Audit execution systems – Check for latency gaps, price slippage, or inefficient routing.

- Use segmentation insights – Adapt your trading strategy to your broker’s competitive landscape.

When used right, trader segmentation becomes more than data – it’s your roadmap to safer profit.

The Bottom Line: Make More Informed Decisions and Manage Operational Risk in Different Markets

In today’s financial markets, economic indicators, geopolitical events, and rapid technological shifts are the norm. Whether you’re trading electric vehicle stocks, mutual funds, or diving into algorithmic trading, understanding trader segmentation and risk triggers is your edge. It’s not just about avoiding losses – it’s about seizing opportunities, optimizing profits, and making informed decisions in the industry of constant change.

If you’re unsure whether your trader segments are helping or hurting, or if you’re seeing strange swings in PnL, Yourfintech can step in. We’re experts in:

- Trader segmentation models

- Execution audits

- Revenue optimization strategies

- Mitigating risks across asset classes

Don’t wait for market volatility or external factors to expose weaknesses in your risk management approach. The time to implement comprehensive trader segmentation is now, before the next market move catches you unprepared.

FAQs

1. What is trader segmentation and why is it important for brokers?

Trader segmentation is the practice of categorizing clients based on their trading behavior, risk profile, and profitability. It’s a powerful tool that helps brokers improve revenue visibility, manage credit risk, and identify traders who might pose higher risk to the business.

2. How does segmentation help manage risk exposure in financial markets?

It reveals hidden risk triggers, improves strategy alignment, and helps brokers proactively address market risk, operational risk, and regulatory risk, while also improving customer satisfaction by tailoring services more effectively.

3. Which trader types carry the highest risk for brokerages?

High-Frequency Traders, News Traders, and Martingale Traders often carry higher risk due to their volatility, speed, and leverage use. Those who borrow funds to increase position size can amplify both gains and losses, making them a potential liability without proper oversight.

4. Can trader segmentation impact investment decisions?

Absolutely. Understanding how different segments perform under various conditions helps brokers and investors align strategies, allocate capital efficiently, and avoid poor investment decisions in volatile or saturated markets.

5. What role do external factors play in trader behavior?

External triggers like economic indicators, interest rates, geopolitical events, and natural disasters can significantly alter trader behavior. Segmentation helps track who reacts to what, and whether their activity increases credit risk or systemic exposure.

6. How can brokers mitigate risks using segmentation?

By regularly auditing execution data, tracking behavioral shifts, and adapting trading strategies in response to segmented insights, brokers can limit credit risk, enhance performance, and reduce exposure across different asset classes.

7. What’s the link between segmentation and the stock market?

Segmentation helps brokers track behavior across mutual funds, sectors like electric vehicles, and individual stock price changes.