Articles

Global Forex Broker Licensing Requirements: Jurisdiction Comparison 2026

Introduction: Why Your Forex Broker License Choice Matters

We get asked about forex broker license options more than almost anything else at YourFintech. “Should I go CySEC or offshore?” “Is an FCA forex broker license worth it?” “What about Vanuatu?”

And honestly, most of the time the question is backwards. People pick a jurisdiction first, then try to build a business model around it. That’s how you end up with a €750K CySEC license and no clients, or an SVG company that can’t open a bank account.

Here’s the uncomfortable truth: there’s no “best” forex broker license. FCA isn’t better than Seychelles. It’s different. More expensive, more credible, more restrictive. Whether that trade-off makes sense depends on who you’re trying to serve and how much capital you’re starting with.

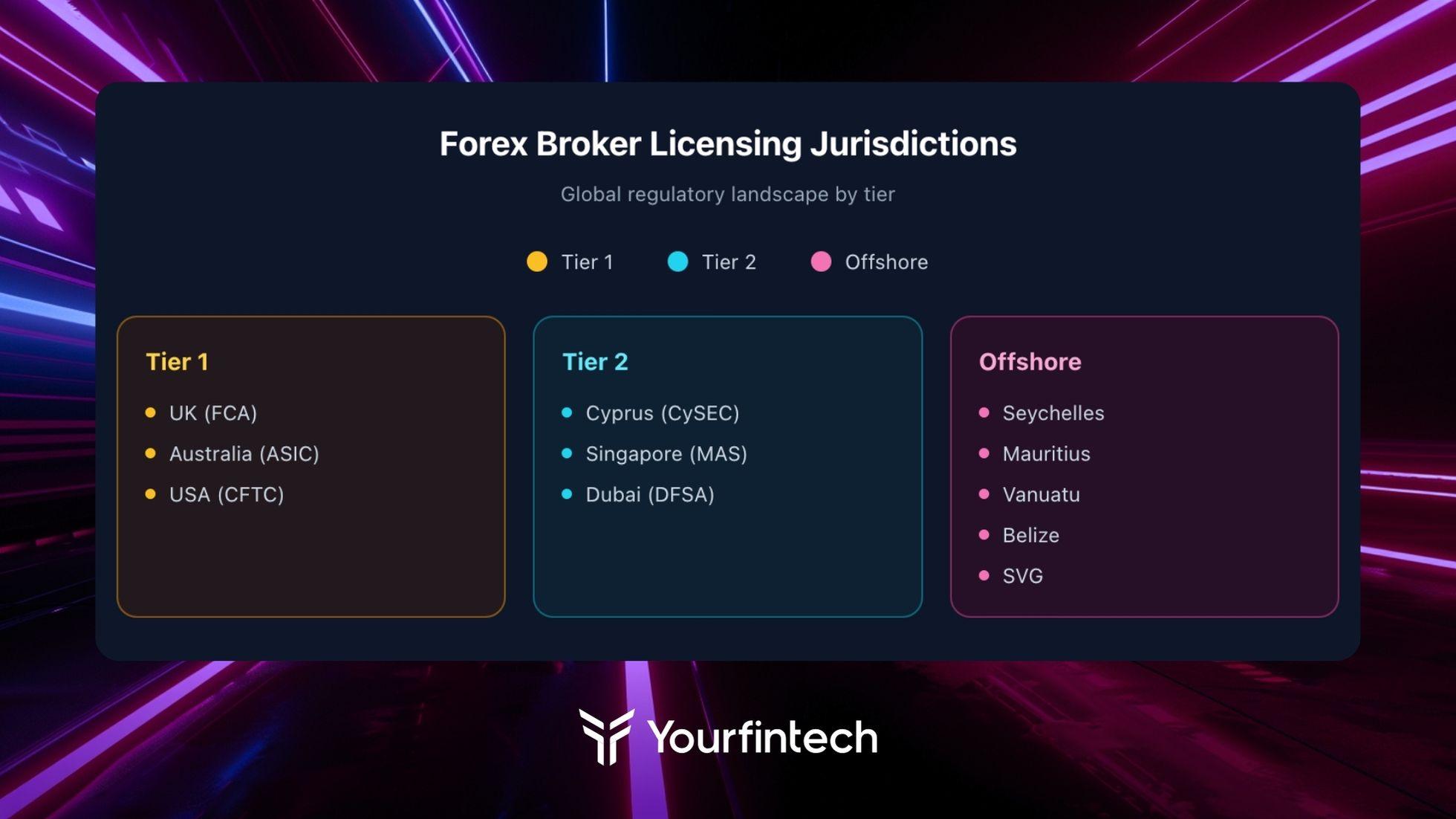

What follows is our breakdown of major forex broker license jurisdictions as of early 2025. We’ve grouped them into tiers based on regulatory reputation and market access—not quality. A Vanuatu license serving Indonesian retail traders isn’t worse than an FCA license; it’s appropriate for a different business.

Fair warning: this stuff changes. CySEC requirements shifted twice while we were writing this. Verify everything with actual lawyers before signing anything.

Tier 1 Forex Broker License Jurisdictions: FCA, ASIC, CFTC

If you’re reading this guide to compare options, you probably can’t afford a Tier 1 forex broker license. Not trying to be harsh—just realistic. These jurisdictions exist for brokers with serious institutional backing or years of profitable operations funding the application.

FCA Forex Broker License (United Kingdom)

The FCA is the one everyone wants. Clients trust it. LPs trust it. Banks trust it. An FCA forex broker license opens doors that stay closed to offshore brokers.

It’s also a nightmare to get.

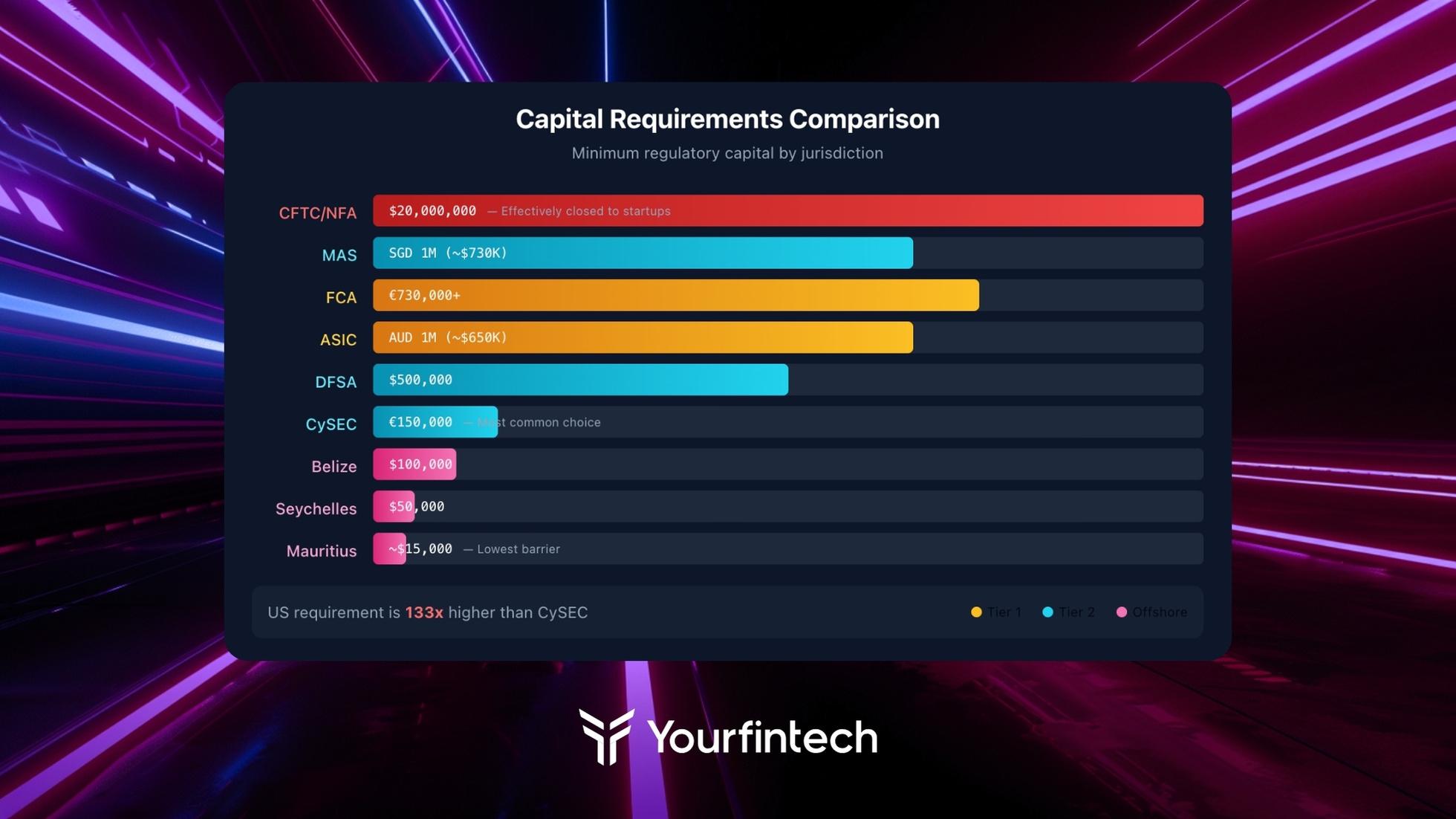

Capital: The minimum numbers you see quoted (€75,000) are basically meaningless for forex brokers. Real capital requirement for a CFD/forex broker serving retail? €730,000+, and that’s before you account for operating costs while you wait 6-12 months for authorization. Budget a million euros minimum if you’re serious.

Timeline: 6-12 months if everything goes perfectly. It won’t. First submissions almost always come back with questions. Add 3-6 months for the back-and-forth.

The substance problem: FCA wants actual UK operations. Not a mailbox and a part-time compliance consultant—actual staff making actual decisions in an actual office. Directors need to pass fitness assessments. Your compliance officer can’t be outsourced. They check.

Restrictions: ESMA leverage limits apply. 30:1 on majors, 2:1 on crypto. No bonuses. No deposit incentives. Marketing rules that will make your acquisition team cry.

Worth it for: Brokers targeting UK professional clients, institutional flow, or anyone who needs premium banking relationships. Not worth it for startups still validating whether anyone wants their product.

ASIC Forex Broker License (Australia)

ASIC used to be the loophole. EU-level credibility without EU-level restrictions. Then in 2021 they implemented leverage caps and suddenly the value proposition got fuzzy.

Capital: AUD 1,000,000 minimum. Plus you’ll need professional indemnity insurance, which isn’t cheap.

Timeline: 6-12 months, but ASIC has publicly complained about being under-resourced. Complex applications can drag to 18 months. We’ve seen it.

The Australian presence thing: You need a responsible manager physically in Australia with relevant experience. Not someone who’s “planning to relocate.” Someone already there. This trips up a lot of applicants.

Restrictions: 30:1 leverage cap now, same as EU. Binary options banned. The arbitrage opportunity that made ASIC attractive five years ago is gone.

Worth it for: Asia-Pacific focused brokers who want regulatory credibility above offshore. Good banking access throughout APAC. Skip it if you need high leverage—that ship sailed.

CFTC/NFA License (United States)

Just… don’t.

Twenty million dollars minimum capital. No, that’s not a typo. $20,000,000. The US effectively banned independent retail forex brokers years ago through the NFA requirements. The only survivors are massive institutions.

Unless you’re backed by a major bank or have somehow accumulated tens of millions in spare capital, cross the US off your list.

Moving on.

Tier 2 Forex Broker License Options: CySEC, MAS, DFSA

This is where most serious brokers actually land. Meaningful forex broker license regulation without impossible capital requirements. If you have €300K-€500K total budget, these are your options.

CySEC Forex Broker License (Cyprus)

CySEC is the default. There’s a reason half the forex industry operates out of Limassol.

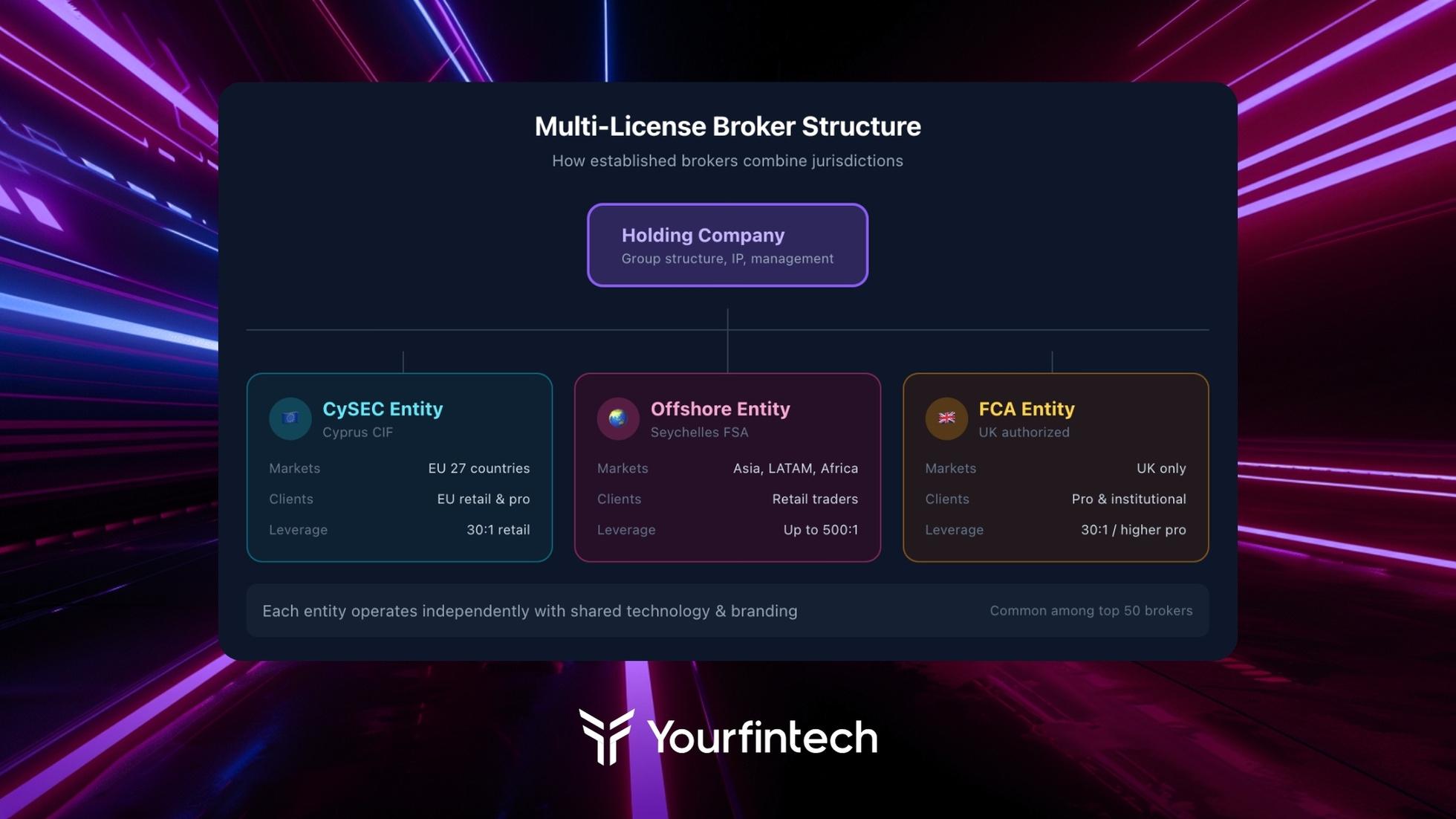

EU passporting (serve all 27 member states with one forex broker license), established infrastructure (lawyers, accountants, and compliance consultants who’ve done this hundreds of times), and capital requirements that are aggressive but achievable.

Capital: €75,000 if you’re pure STP, €150,000 if you’re market making. But here’s what nobody mentions upfront: additional capital requirements kick in based on operational risk calculations. Budget €200K-€250K to be safe.

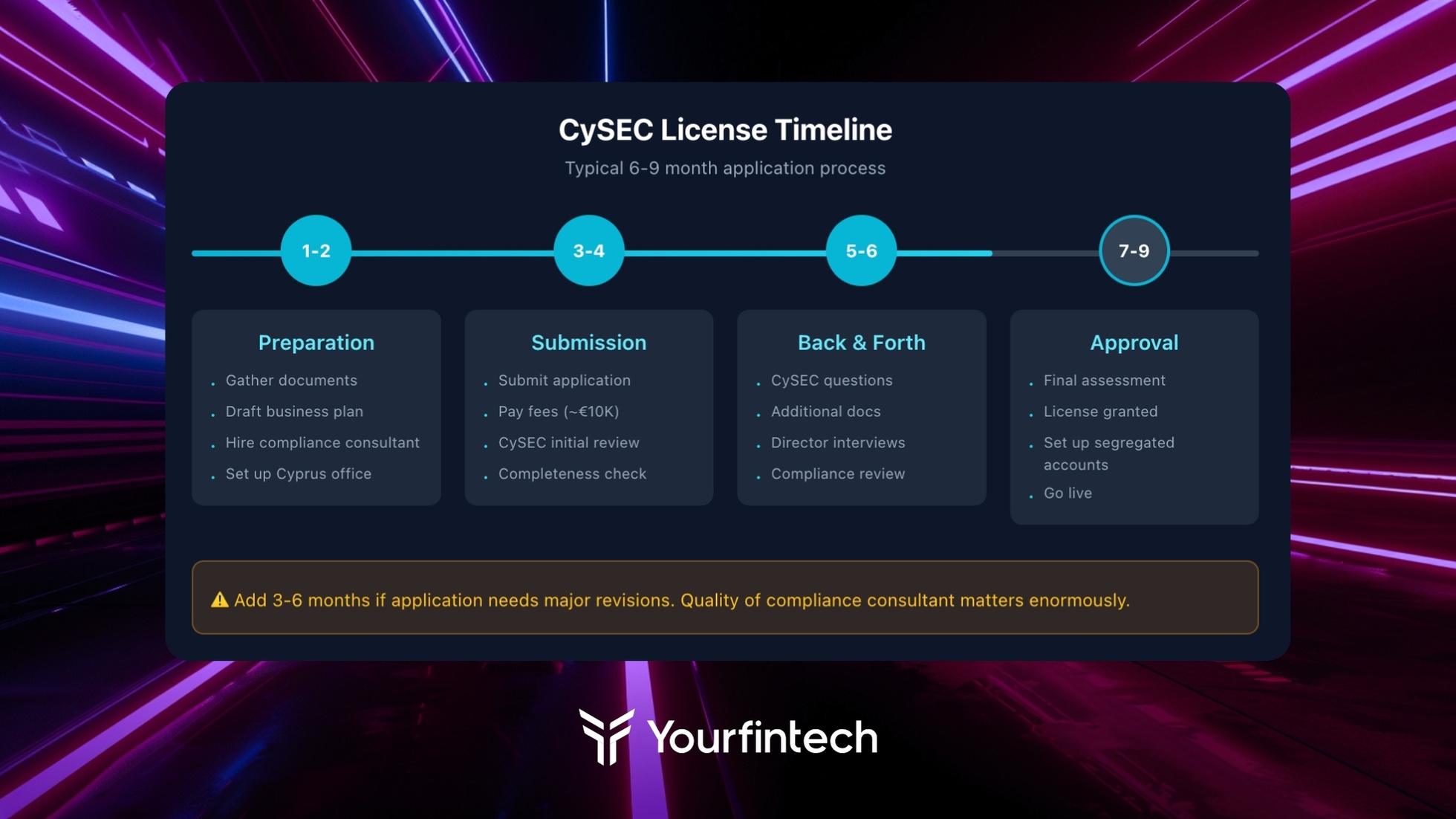

Timeline: 6-9 months with good preparation. Seen it done in 5. Also seen it drag past a year when applications need rework. Quality of your compliance consultant matters enormously here.

Practical stuff: You’ll need a Cypriot office. At least one director on the ground (second can be foreign). Compliance officer approved by CySEC—they interview them separately. Client funds in EU banks, segregated.

Restrictions: Full ESMA package. 30:1 retail leverage, no bonuses, risk warnings everywhere. Professional client classification lets you offer more leverage, but qualification requirements are strict.

Worth it for: Anyone targeting EU retail or professional clients. The obvious choice for growth-stage brokerages who’ve outgrown offshore limitations. Also the most common stepping stone—launch CySEC, add FCA later if needed. Learn more about connecting with liquidity providers once licensed.

MAS License (Singapore)

Singapore has arguably the best regulatory reputation in Asia. MAS is thorough, serious, and doesn’t hand out licenses to anyone who asks.

Capital: SGD 1,000,000 base, plus risk-based add-ons. Similar ballpark to ASIC.

Timeline: 6-12 months. MAS asks detailed questions. Lots of them. Be prepared to explain your business model, risk management, and compliance arrangements in exhaustive detail.

The leverage problem: 20:1 maximum. That’s it. Among the strictest in Asia. If your model depends on offering 100:1 or 500:1 to retail clients, MAS doesn’t want you.

Worth it for: Brokers targeting Southeast Asian professional and institutional clients. Opens doors with Asian banks. The low leverage limit makes retail mass-market models essentially unworkable.

DFSA License (Dubai/DIFC)

Dubai has been positioning DIFC as a credible financial center for years, and it’s working. DFSA regulation is modeled on international standards and carries real weight in the Middle East.

Capital: USD 500,000 for firms dealing as principal. Actual requirements calculated per DFSA’s prudential rules—expect something in that range.

Timeline: 4-9 months. DFSA has gotten more efficient recently.

The DIFC bubble: Your license is valid for DIFC—the financial free zone. Marketing to UAE retail clients outside DIFC involves additional complexity. Not impossible, but not automatic either.

Worth it for: GCC and Middle Eastern focus. Prestige in the region. Also useful if you want a regulated entity between European and Asian time zones for operational reasons.

Offshore Forex Broker License: Fast, Cheap, Different Trade-offs

Offshore licensing gets a bad reputation in some circles. Unfairly, mostly.

These are legitimate regulatory frameworks. Brokers operating under an offshore forex broker license aren’t scammers by definition. Plenty of successful operations serve Asian and Latin American retail markets perfectly well from offshore structures.

The actual trade-offs: banking access is harder, some LPs won’t onboard you, certain payment processors charge more (or refuse entirely), and some client segments won’t deposit with “unregulated” brokers (even though you are regulated, just not by a jurisdiction they recognize).

If those limitations don’t apply to your target market, an offshore forex broker license can make sense.

Seychelles FSA License

Capital: USD 50,000 minimum. Annual fees around $2,500-3,000.

Timeline: 2-4 months typically.

Banking: Better than some offshore options. Some LPs and payment processors work with Seychelles FSA licensees. Not all, but enough to operate.

Mauritius FSC License

Capital: Around USD 15,000. Among the lowest actual requirements.

Timeline: 3-6 months.

Positioning: Mauritius sometimes gets pitched as “offshore with improving reputation.” Tax treaties with various countries. Bridge between offshore efficiency and emerging market legitimacy. Whether that framing holds up depends on who you’re talking to.

Vanuatu VFSC License

Capital: USD 50,000. Application fees $20-30K.

Timeline: 1-3 months. Fastest option on this list.

Reality check: Limited banking acceptance. You’ll probably end up with crypto payment rails and smaller PSPs. Fine for certain business models, dealbreaker for others.

SVG (St. Vincent)

SVG isn’t a forex broker license. The FSA explicitly doesn’t regulate forex. You’re registering a company, not obtaining authorization.

Cost: Incorporation fees only. Couple thousand dollars.

Timeline: Days.

The catch: Serious LPs won’t touch you. Most payment processors won’t either. SVG-only operations are increasingly difficult to sustain as service providers tighten policies. Useful as a holding structure maybe, but not as a primary operating entity anymore.

Belize IFSC License

Capital: USD 100,000.

Timeline: 2-4 months.

Middle ground: Actual regulatory license (unlike SVG), moderate acceptance from service providers. If you want an offshore forex broker license with some credibility, Belize sits between the extremes.

Forex Broker License Comparison: The Table Everyone Asks For

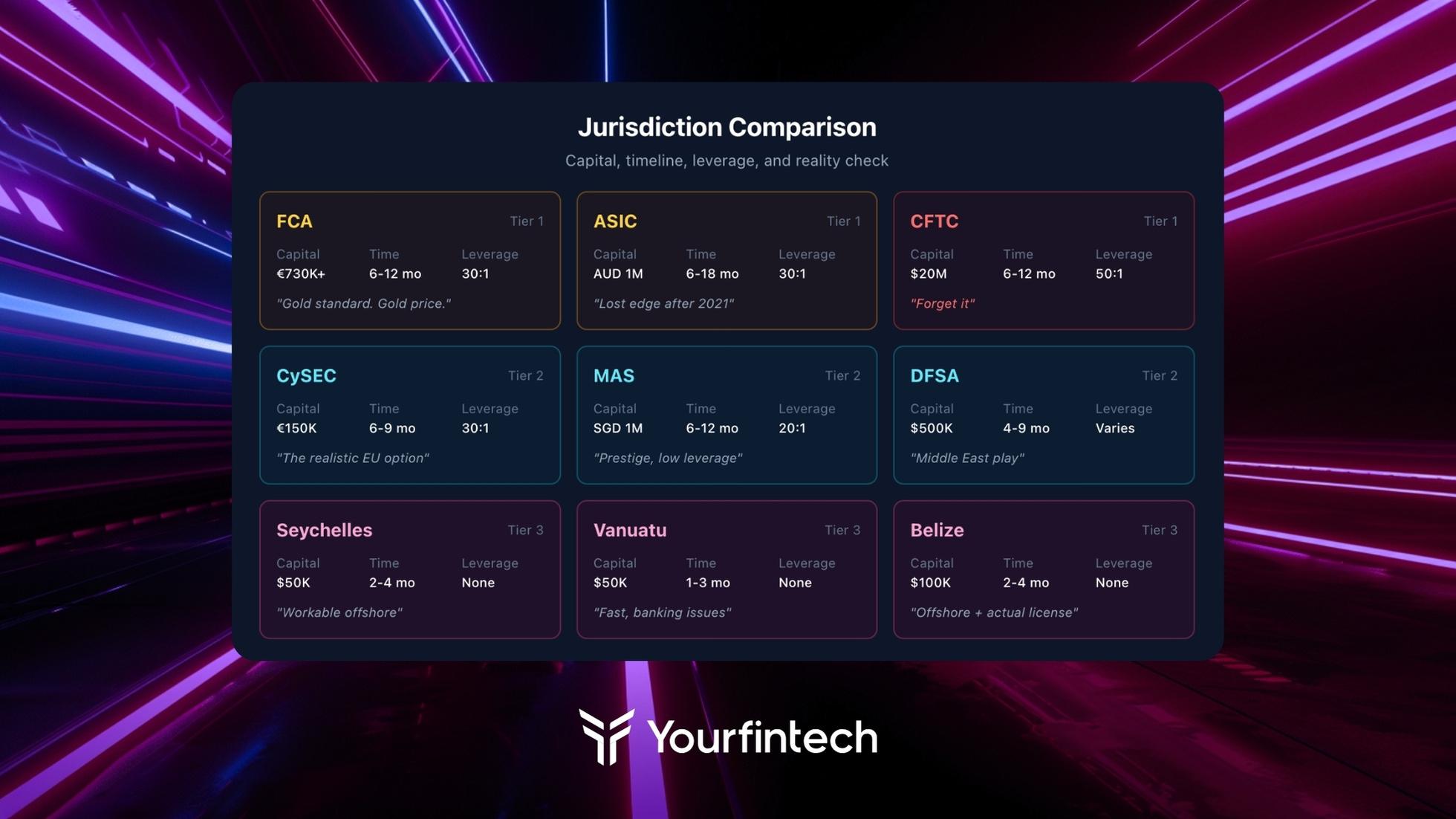

| Jurisdiction | Capital | Timeline | Leverage | Reality |

|---|---|---|---|---|

| FCA | €730K+ | 6-12 mo | 30:1 | Gold standard. Gold price tag. |

| ASIC | AUD 1M | 6-18 mo | 30:1 | Lost edge after 2021 |

| CFTC/NFA | $20M | 6-12 mo | 50:1 | Forget it |

| CySEC | €150K | 6-9 mo | 30:1 | The realistic EU option |

| MAS | SGD 1M | 6-12 mo | 20:1 | Prestige, low leverage |

| DFSA | $500K | 4-9 mo | Varies | Middle East play |

| Seychelles | $50K | 2-4 mo | None | Workable offshore |

| Vanuatu | $50K | 1-3 mo | None | Fast, banking issues |

| Belize | $100K | 2-4 mo | None | Offshore + actual license |

How to Choose Your Forex Broker License

Wrong approach: “What’s the best forex broker license?”

Right approach: Answer these first.

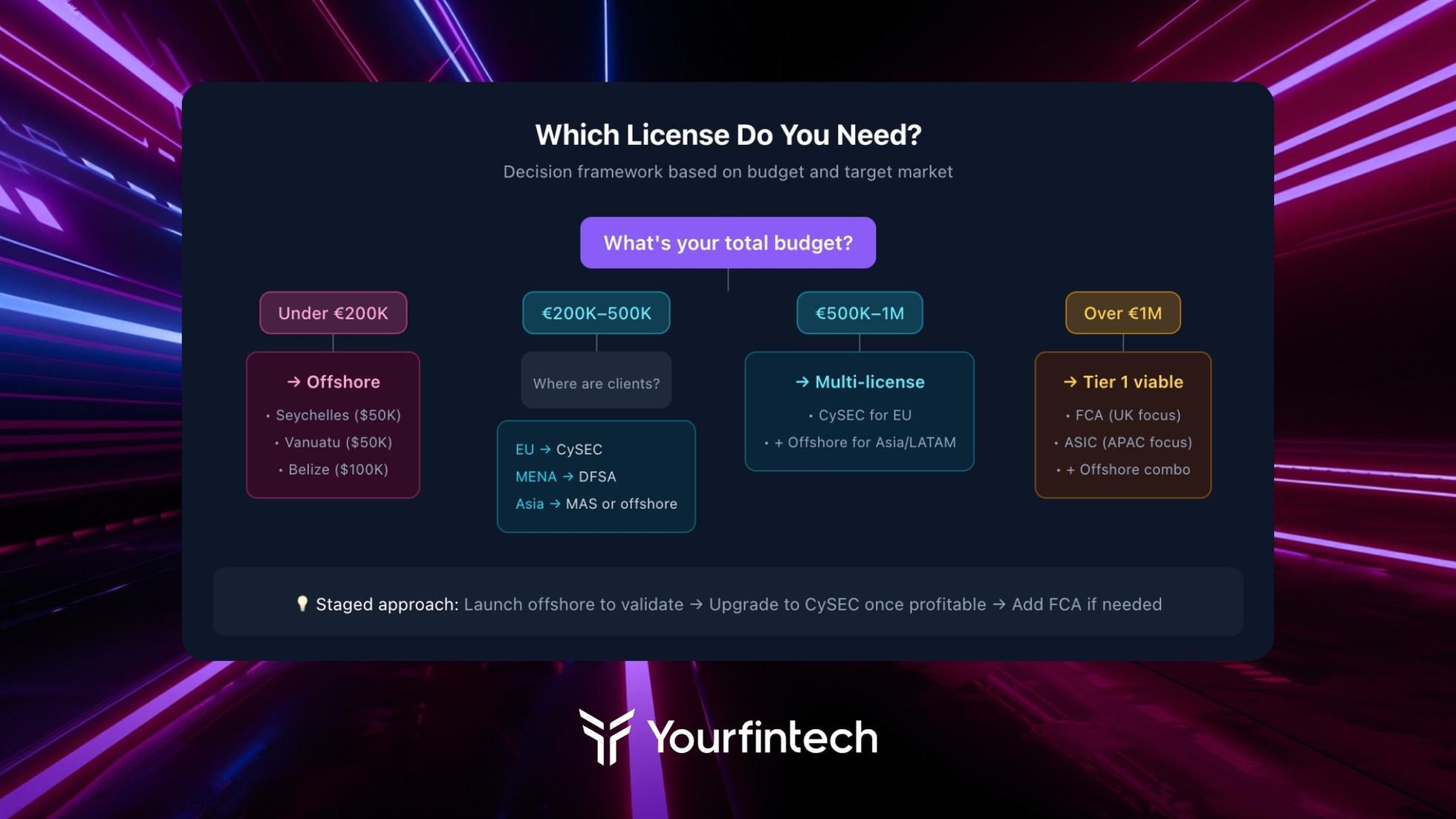

Where are your clients? EU clients need EU authorization—period. UK clients post-Brexit need FCA specifically. US clients are off-limits. Asian retail? Offshore often works fine.

What do you have to spend? Under €200K total budget? An offshore forex broker license is your only realistic path. €300-500K? CySEC becomes possible. North of €1M? Now you have options.

How fast do you need to launch? Three months? That’s Vanuatu or Seychelles. Twelve months? Tier 2 is viable.

What’s your LP situation? Planning to work with Tier 1 liquidity providers directly? Most require Tier 1-2 licensing. Going through a PoP? They’re less picky. B-book model? Licensing matters less for LP purposes.

One thing we see work well: staged approach. Launch with an offshore forex broker license to validate the model and generate initial revenue. Once profitable and proven, apply for CySEC or equivalent. Use offshore entity for markets where it works, regulated entity for markets where it matters. More complex operationally, but matches regulatory investment to actual business stage.

What doesn’t work: burning your runway on a Tier 1 forex broker license before you’ve proven anyone wants what you’re selling.

Conclusion

Pick a forex broker license jurisdiction that matches your capital, timeline, and target market. Not your ego.

FCA is great if you can afford to wait a year and spend a million euros before serving your first client. Most people can’t, and that’s fine. CySEC exists for exactly that situation. Offshore exists for earlier stages or specific market focuses.

The brokers who get this right treat their forex broker license as infrastructure that serves the business—not a trophy to chase before the business exists.

Need help connecting the technical infrastructure once you’re licensed? Explore our Liquidity Directory for providers across all regulatory tiers.

And seriously: verify all of this with actual legal counsel before committing. We’ve watched requirements shift mid-application too many times to pretend this guide will stay accurate forever.