Articles

When to Cut a Trader Loose – The Hard Calls That Keep a Prop Firm Alive

Running a prop trading firm isn’t just about funding traders and watching profits roll in. It’s about making tough decisions, ones that protect your capital, your reputation, and the future of your business.

What happens when a trader ignores risk, rejects feedback, or refuses to follow structure? The truth is, one undisciplined trader can:

- Skew your firm’s performance metrics

- Drain risk capital

- Spread bad habits to other traders

If you’re serious about building a successful prop firm, you need systems that go beyond just tracking P&L. The hard truth? Sometimes the best traders aren’t the ones making the most money; they’re the ones who respect your systems and understand that discipline, not profit alone, keeps a proprietary trading firm alive.

Key Takeaways

- Cutting undisciplined traders protects the entire risk structure of a prop firm.

- Tracking coachability, decision-making, and drawdown behavior is critical.

- Even high-performing traders should follow rules to maintain firm integrity.

Beyond P&L: What Really Matters in Prop Trading

If you’re running a prop firm or considering how to start a prop firm, you need to understand that profit and loss statements only tell half the story. The most resilient proprietary trading firms build systems that don’t just measure P&L, but track four critical elements:

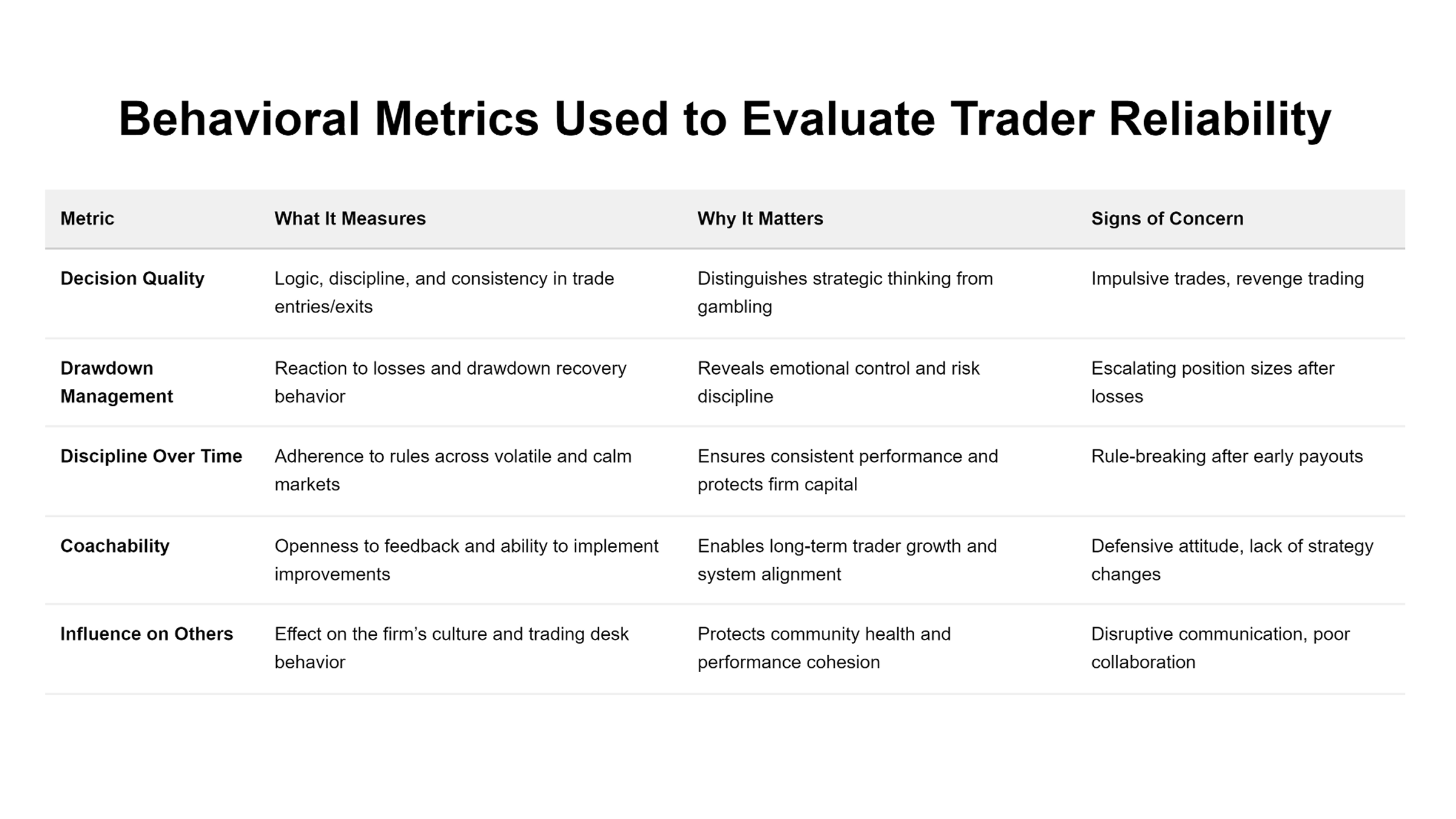

Decision Quality

Does your trader make calculated decisions based on market analysis, or do they rely on gut feelings and hope? Proper risk management often distinguishes successful traders from those who fail in the industry, and decision quality is where this difference becomes apparent.

Discipline Over Time

Anyone can follow rules during evaluations, but what happens when market volatility hits? Successful prop trading requires consistency, not just during the good times but especially when the markets test your resolve.

Drawdown Management

It’s not just about maximum drawdown levels; it’s about how traders handle losses. Do they compound mistakes or learn from them? Most traders are lacking because they either bet too much or at least refuse to trim their losses early.

Coachability & Accountability

The best prop traders aren’t those who never make mistakes; they’re the ones who learn from feedback and adapt their strategies. This trait becomes especially valuable when you’re scaling your prop trading technology and need traders who can evolve with your platform.

The Hard Truth About Cutting Traders Loose in Own Prop Trading Firm

Here’s where many prop trading firms struggle: Sometimes the best thing for both the trader and the firm is a clean break, especially when behavior puts the entire risk structure at stake. Letting a trader go doesn’t mean they failed. It means you take standards seriously.

Cutting someone loose protects the system. It reaffirms to your team that your risk management policies are not negotiable, even for high earners.

Many professional traders start strong but become lax after a few payouts. This is where too many firms bend. They keep the trader on because of past performance, hoping discipline will return.

But guess what? Hope is not a risk strategy.

The Real Questions Every Prop Firm Company Owner Must Ask

If you’re running your own prop firm, ask yourself these critical questions:

Do your risk rules apply equally, or only until a trader “makes it”?

If a trader consistently pushes boundaries, skips trading strategy reviews, or resists feedback, they signal that they are not coachable. That’s your cue. Your proprietary trading activities must remain above board, not just for internal consistency but also for regulatory requirements set by the Securities and Exchange Commission and other financial institutions. Don’t wait until one misstep causes loss of capital or a compliance violation.

How do you assess traders beyond their P&L performance?

What’s changed in the retail space is the automation of risk management and trader assessments, but technology alone can’t measure character and coachability.

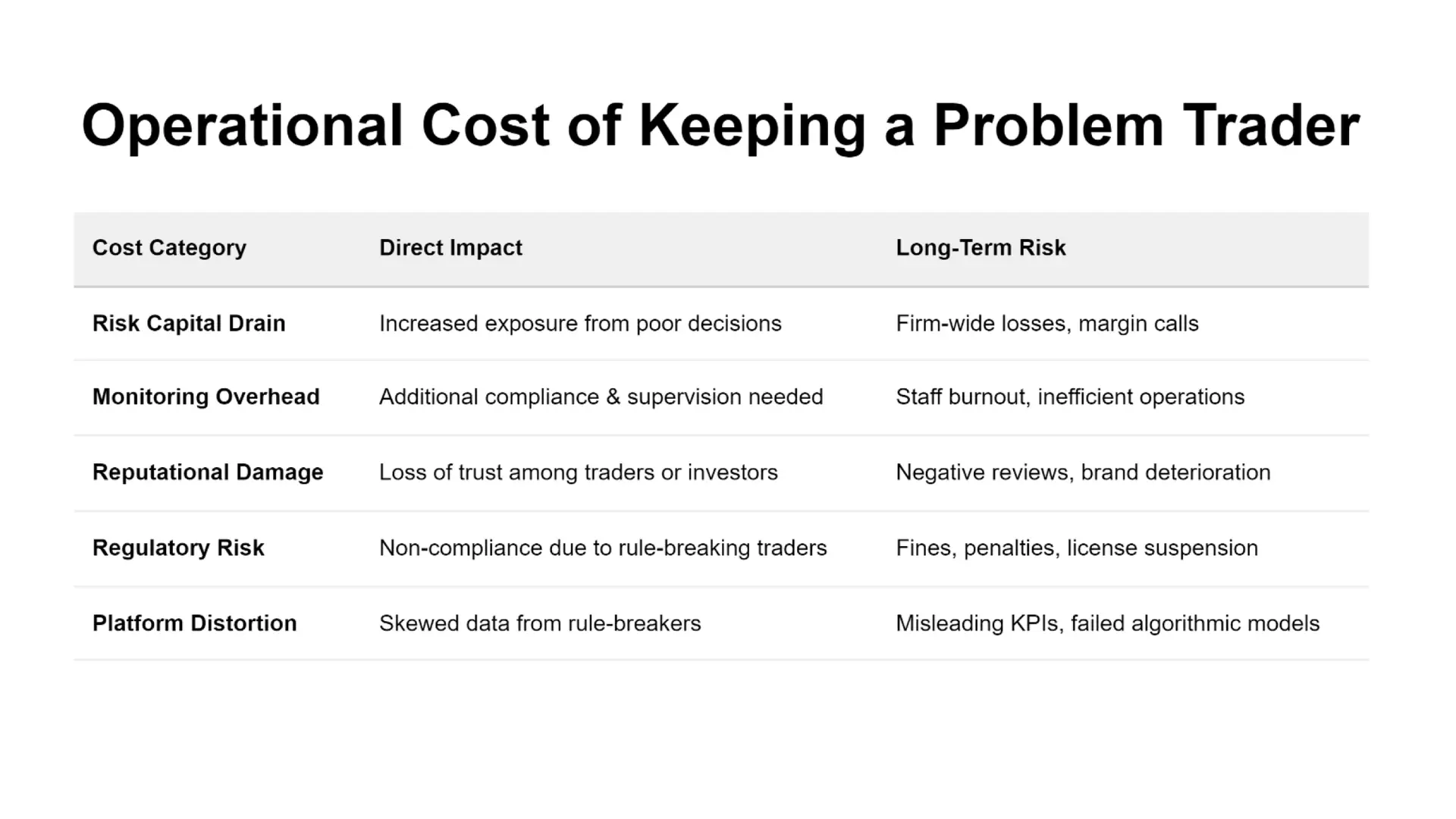

Are you prepared for the operational costs of problem traders?

Beyond direct losses, undisciplined traders drain resources through increased monitoring, additional risk management overhead, and potential regulatory compliance issues.

You Can’t Scale Without a Structured Business Model

If you’re aiming to start a prop firm or already have your own prop trading company, think of your traders as extensions of your business model.

That means consistent:

- Enforcement of regulatory compliance and legal standards

- Use of robust trading systems and proprietary trading platforms

- Access to reliable trading platforms and technology infrastructure

- Integration of liquidity solutions and risk engines

- Deployment of prop trading software with built-in risk management systems

Structure isn’t about stifling traders – it’s about enabling sustainable growth and ensuring sufficient liquidity across asset classes.

And yes, if you’re using a white label prop firm solution, these systems must be hard-coded into your prop trading technology from the start.

Building Your Own Prop Firm That Lasts

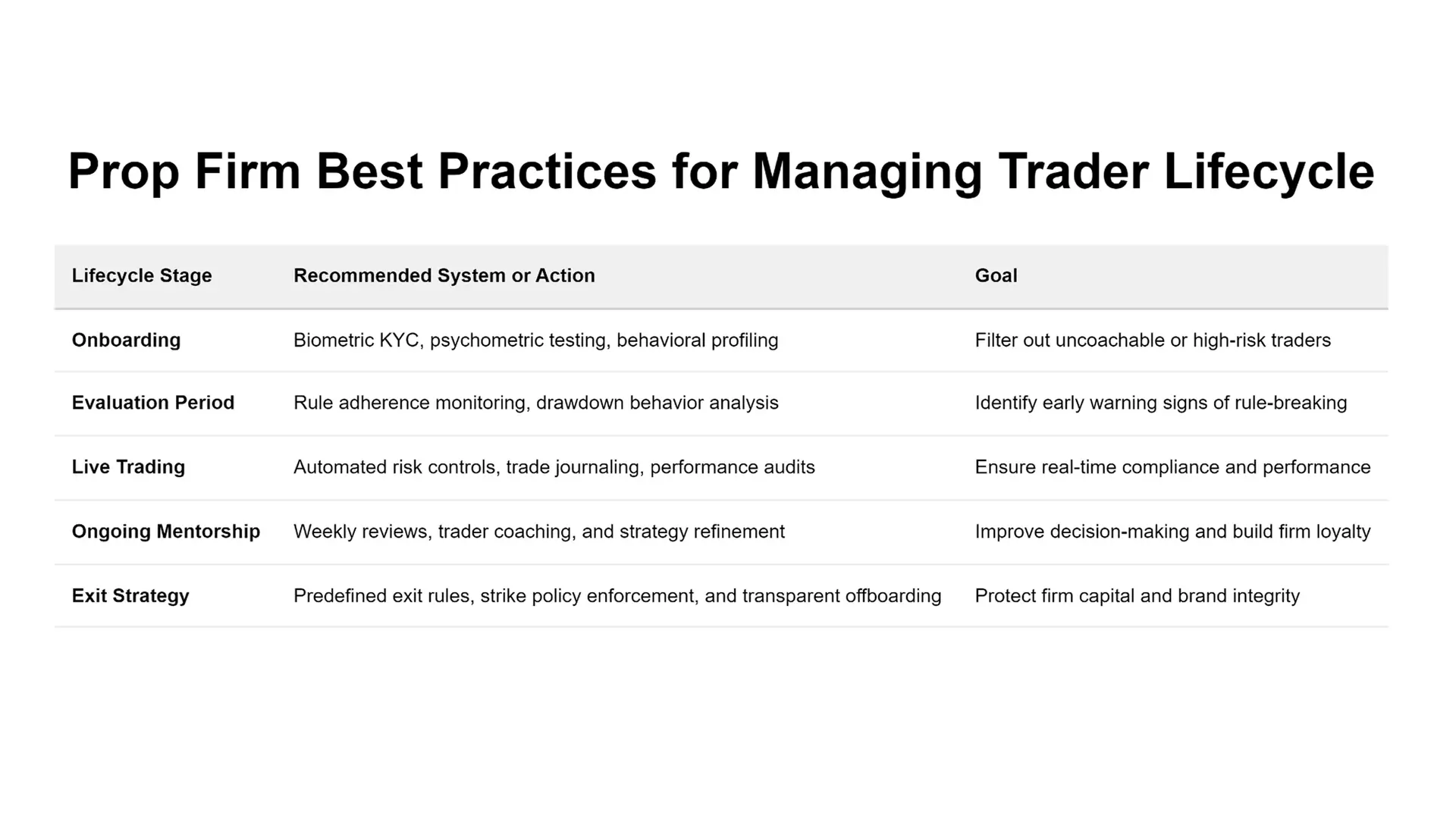

The best prop trading firms don’t just react to problem traders; they prevent them from becoming problems in the first place. This starts with your onboarding process and extends through every aspect of your trading platform. Here’s how the best firms stay ahead:

Invest in Robust Technology: A proprietary trading desk powered by advanced technology is non-negotiable. Whether it’s algorithmic trading tools or real-time performance analysis, your trading systems need to keep up with the fast-paced financial markets.

Prioritize Risk Management: Strong risk management systems are the backbone of any prop firm. They protect your capital and ensure operational efficiency, even when market volatility strikes.

Foster a Culture of Accountability: Encourage experienced traders to take ownership of their decisions. Use trading contests or investor CRM portals to reward discipline and identify successful traders.

Stay Compliant: Legal and regulatory compliance isn’t just a box to check – it’s a competitive edge. Firms that align with Securities and Exchange Commission standards build trust and attract serious talent.

Monitor and Mentor: Don’t just assess traders during onboarding. Continuously evaluate their performance, provide feedback, and invest in their growth. A trader who’s coachable today could be your top performer tomorrow.

When to Make the Call

- Repeated risk breaches – If they ignore limits, they’re a liability.

- Defensive or uncoachable – Traders who won’t learn won’t last.

- Negative influence on others – Bad habits spread fast.

Success Requires Tough Calls

Running a successful prop trading firm is about more than building dashboards and tracking profits. It’s about having the courage to make the hard calls.

- Evaluate your traders not just on P&L, but on behavioral metrics

- Build systems that support performance integrity

- Cut loose those who refuse to grow, because standards matter

Whether you’re looking to open a prop firm, improve your trading operations, or build out a competitive edge with advanced tools like algorithmic trading, it all comes down to protecting your core.

When the market moves fast and market volatility tests your limits, you need traders who don’t just trade but respect the structure.

So ask yourself: Are you running a trading group? Or are you building a high-integrity, world-class prop firm that stands the test of time?

FAQs

1. Why is cutting a trader loose such a critical decision in prop trading activities?

Because one trader’s undisciplined behavior can impact a significant portion of the firm’s capital and risk structure. In prop trading activities, especially when managing firm capital rather than your own money, this decision is about preserving the integrity of your trading desk and ensuring long-term sustainability.

2. How do prop trading firms handle market volatility when assessing traders?

Top firms use strict risk rules, technology-driven performance tracking, and behavioral metrics to handle market volatility. Instead of reacting emotionally to sharp price moves, firms assess how well traders stick to their strategies under pressure, not just how much they profit.

3. Is market making affected by undisciplined traders?

Absolutely. In market making, precision and risk control are non-negotiable. A trader who fails to manage exposure properly can destabilize liquidity flows and put the firm’s reputation and capital at risk. Consistency is essential in both trend trading and market-making strategies.

4. How does this approach differ from hedge funds or investment banks?

While hedge funds and investment banks also value discipline, prop trading firms often provide capital to individual traders with more autonomy. This setup demands tighter behavioral accountability since poor performance affects the firm’s own balance sheet, not just client portfolios.

5. What role does careful planning play in deciding to let a trader go?

It’s not an emotional call; it’s part of careful planning and strong leadership. Successful prop firms plan for trader development, risk management, and capital preservation. Removing a misaligned trader reinforces standards and protects the firm’s long-term goals.