Articles

How Criminal Activity Is Targeting Prop Firms

You might think of prop trading firms as fast-moving, tech-savvy companies filled with ambitious prop traders – and you’d be right. However, as these firms gain popularity, they’ve become prime targets for fraudsters.

Imagine you’re a skilled trader, leveraging a prop firm’s capital to amplify your trading strategies. Suddenly, your account is flagged, your profits frozen, or worse, your identity is stolen. Why? Because the prop trading industry, now a multibillion-dollar powerhouse, has become a prime target for criminals. From identity fraud to money laundering, proprietary trading firms face sophisticated threats that pose a significant risk to traders, firms, and investor confidence.

So, how exactly is criminal activity targeting prop firms today? And what does it mean for traders, capital security, and the future of proprietary trading? Let’s uncover the dark side of a booming $3 billion industry.

Key Takeaways

- Criminal activity is on the rise, with identity fraud, bots, and laundering targeting prop firms in 2025.

- Over 8% of accounts show identity concerns, while 1.8%+ of transactions suffer refund abuse.

- Money laundering via crypto payouts is a growing threat, requiring strict AML checks.

- Traders must choose regulated, secure firms and steer clear of firms with weak verification systems.

The Explosive Growth of Prop Firms And Why Criminals Are Taking Notice

Proprietary trading firms have revolutionized how individual traders access financial markets. These firms provide trading capital to skilled traders who would otherwise be limited by their own money, creating opportunities to trade financial markets with substantial leverage across stocks, futures trading, commodities, and other financial instruments.

But here’s the unsettling truth: as over 200,000 retail traders participate in prop trading each year, criminals have identified this industry as a goldmine for exploitation. The prop trading industry’s rapid expansion has created vulnerabilities that bad actors are systematically targeting.

Consider this: when successful traders can generate profits using a firm’s capital rather than their own accounts, the appeal is obvious. However, this same model attracts those seeking to manipulate the system for illegal gains. The question isn’t whether criminal activity exists in prop trading – it’s how extensive the problem has become.

The Alarming Statistics Behind the Scenes

The data reveals a troubling picture that many prop firms prefer to keep quiet:

- Market Size Under Threat: The estimated prop firm market size of $3+ billion annually represents a massive target for criminal exploitation

- Identity Crisis: Over 8% of accounts are flagged for suspicious identity behavior – that’s approximately 16,000 potentially fraudulent accounts among active participants

- Financial Horror: 1.8% of transactions face chargeback or refund abuse, translating to millions in disputed funds

- Global Impact: Fintech fraud losses exceeded $1.5 billion in 2024, with prop firms representing a significant portion of these losses

These aren’t just numbers on a spreadsheet – they represent real threats to legitimate traders, prop firms, and the integrity of financial markets themselves.

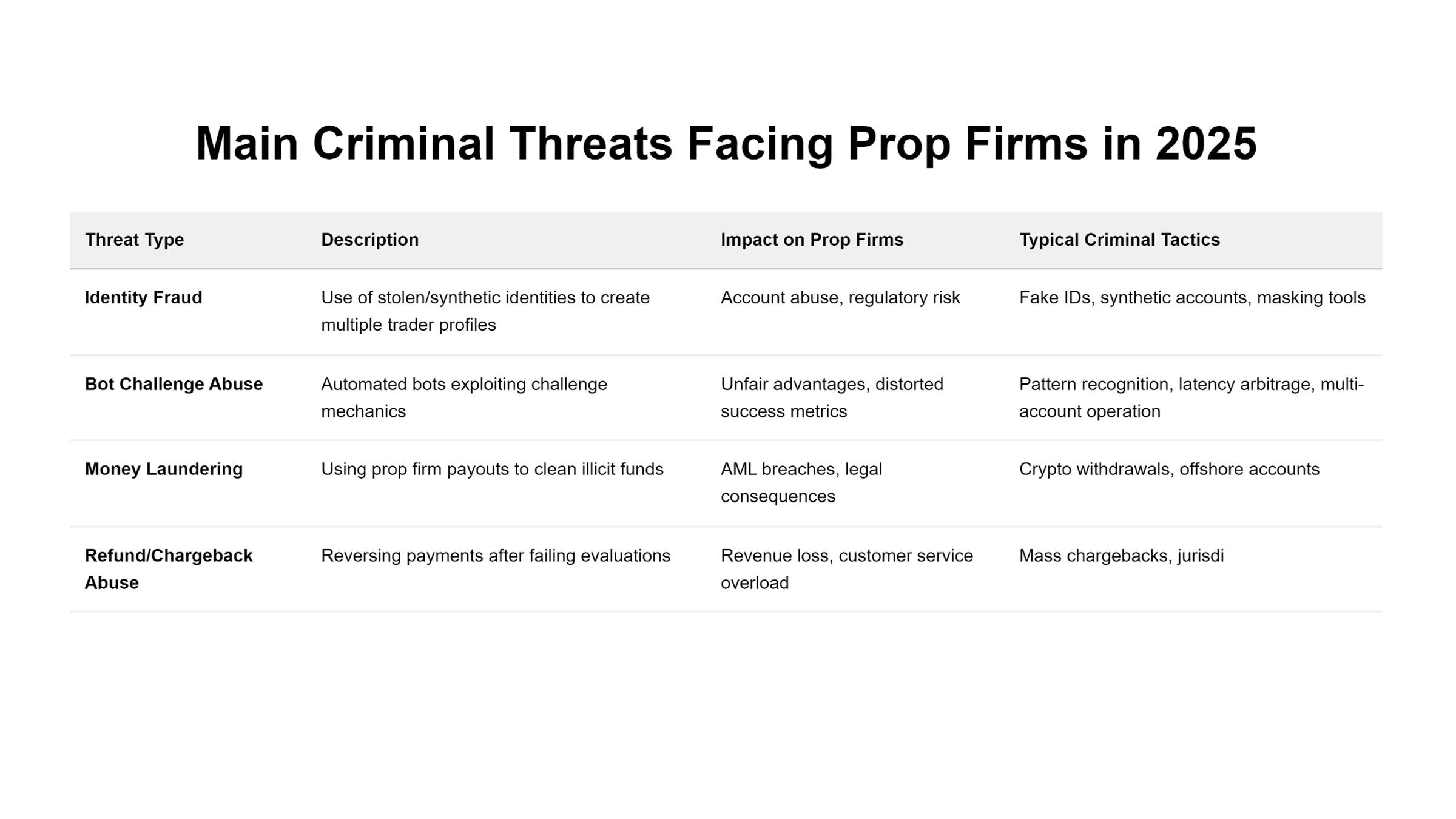

The Five Criminal Strategies Terrorizing Prop Trading Firms

Let’s explore the key criminal activities targeting prop firms and how they threaten the industry’s sustainable growth.

1. Identity Fraud & Multi-Account Abuse in Proprietary Trading

How many traders do you think are actually who they claim to be? The reality might shock you.

Criminal networks are deploying sophisticated identity fraud techniques using stolen or synthetic IDs to create multiple accounts across various prop firms. These schemes allow bad actors to bypass trading limits, circumvent bans, and exploit welcome bonuses repeatedly.

The most dangerous aspect? These criminals often use the accounts of successful traders as templates, copying trading strategies and behavioral patterns to avoid detection. They’re not just stealing identities – they’re stealing trading success itself.

The Criminal’s Playbook:

- Acquire stolen personal information from data breaches

- Create synthetic identities combining real and fake data

- Open multiple funded accounts across different prop firms

- Use advanced techniques to mask digital fingerprints

Imagine trying to trade financial instruments ethically, only to compete with ghost traders gaming the system using fake IDs. For prop firms, this is not just a fraud issue; it’s a regulatory compliance nightmare.

Solution: Leading firms are implementing biometric KYC, device fingerprinting, and IP tracking to detect and shut down these accounts before they gain traction.

2. Bot Exploits & Challenge Abuse

What happens when automated bots become better at passing prop firm challenges than human traders? The answer is a systematic exploitation that threatens the entire evaluation process. It’s like high-frequency trading on steroids.

Sophisticated trading bots are being programmed to pass prop firm challenges by exploiting predictable market patterns and using latency advantages. These bots can farm strategies across bulk accounts to hit trading goals, creating an unfair advantage that undermines legitimate traders who invest time and effort in developing their trading skills.

The Technical Threat:

- High-frequency trading algorithms designed specifically for challenge environments

- Latency arbitrage strategies that exploit microsecond delays

- Pattern recognition systems that identify and exploit recurring market inefficiencies

- Bulk account management systems that can operate hundreds of accounts simultaneously

These tactics undermine the integrity of funded programs. It’s not just unfair to individual traders trying to succeed on merit; it threatens the entire prop trading industry. Furthermore, some of these bots are so sophisticated that they can mimic human trading patterns, making detection increasingly difficult.

Solution: Smart prop firms detect unnatural trade patterns and implement randomized execution environments to protect against bot behavior.

3. Money Laundering Through Payouts

One of the scariest trends is the use of prop firms for money laundering. Here’s how it works: bad actors deposit dirty money, then trade just enough to request a payout, often in crypto or through offshore accounts, to turn it into “clean” money. The complexity increases when crypto trading and offshore payouts obscure the money trail.

The Laundering Process:

- Dirty money enters through seemingly legitimate challenge fees and account funding

- Coordinated trading activities across multiple accounts create artificial profit scenarios

- Rapid withdrawals, often to different jurisdictions or cryptocurrency wallets

- Use of a prop firm’s legitimate business structure to justify large financial transfers

This not only puts firms at legal risk but severely impacts investor confidence, especially in firms without strict rules or AML controls.

Solution: Firms must run AML checks, monitor for rapid withdrawals and location anomalies, and avoid shady client funds flows.

4. Refund Abuse & Chargebacks

What if losing money could actually make you money? Welcome to the world of systematic refund abuse.

Failed traders are increasingly reversing payments through chargeback mechanisms, turning their trading losses into recovered funds. More troubling is the appearance of organized groups that coordinate mass refund abuse, targeting prop firms’ policies and exploiting weaknesses in dispute resolution processes.

The Abuse Patterns:

- Systematic use of challenge periods to extract maximum value before initiating chargebacks

- Group coordination to overwhelm the prop firms’ dispute handling capabilities

- Exploitation of regulatory differences between jurisdictions

- False claims of service inadequacy to justify payment reversals

The psychological warfare extends beyond simple fraud – it’s designed to create unsustainable financial pressure on legitimate prop firms.

Solution: Having strong Terms & Conditions, fraud scoring tools, and solid audit trails is key for legal protection and long-term sustainable growth.

5. Brand Attacks & Review Manipulation

The final frontier of criminal activity isn’t about money – it’s about destroying trust itself.

Criminal networks are launching sophisticated reputation attacks against prop firms through fake reviews, manipulated screenshots, and coordinated smear campaigns across platforms like Reddit, Trustpilot, and YouTube. These attacks serve dual purposes: damaging legitimate firms while promoting fraudulent alternatives.

The Information War:

- Creation of fake negative experiences to damage competitor reputations

- Manipulation of trading screenshots to support false claims

- Coordinated social media campaigns to amplify negative sentiment

- Strategic timing of attacks to coincide with firm growth periods or regulatory reviews

This represents perhaps the most insidious threat – the weaponization of public opinion against legitimate businesses.

Solution: Proactive public monitoring, transparent responses, and legal follow-ups can help preserve credibility and restore trader loyalty.

| Tool/Method | Purpose | Effectiveness |

| Biometric KYC | Verifies identity via facial/fingerprint data | High |

| Device Fingerprinting | Tracks device/browser to detect duplication | Medium to High |

| IP Behavior Analytics | Detects unusual logins or trading locations | Medium |

| Smart Bot Detection | Flags unnatural trading patterns | Medium to High |

| AML Transaction Monitoring | Monitors payout anomalies & crypto withdrawals | High |

| Legal Dispute Tracking | Builds evidence for chargeback responses | Medium |

Why This Matters to Every Trader in Financial Markets

You might think these criminal activities only affect prop firms, but the reality is far more personal. Every fraudulent account, every bot exploit, and every money laundering scheme contributes to:

- Increased Fees: Prop firms must recover fraud losses through higher challenge fees and stricter profit splits

- Stricter Rules: Legitimate traders face more stringent verification processes and trading restrictions

- Reduced Opportunities: Some firms have withdrawn from certain markets or reduced funded account offerings

- Market Instability: Artificial trading activities can distort price discovery and increase volatility

- Regulatory Backlash: Government intervention often restricts legitimate activities to prevent criminal abuse

The criminals aren’t just stealing from prop firms; they’re stealing opportunities from legitimate traders.

Whether you’re working with your own capital or operating a funded account, the stability of prop trading firms directly affects your ability to trade financial markets safely. Fraud hurts everyone, from individual traders to hedge funds and financial institutions providing liquidity.

As a trader, look for firms that:

- Invest in robust risk management

- Enforce regulatory requirements

- Offer clear profit split rules

- Maintain secure trading platforms

The next evolution in prop firm security will likely include blockchain-based identity verification, quantum-resistant encryption, and AI systems so advanced they can predict fraudulent behavior before it occurs. But perhaps more importantly, the industry needs to develop a culture of transparency and cooperation that makes criminal exploitation increasingly difficult.

The Crossroads of Opportunity and Security

How criminal activity is targeting prop firms isn’t just a story about fraud – it’s a story about the future of financial opportunity. As criminals become more sophisticated, the industry must evolve its defenses while preserving the accessibility and opportunity that make prop trading revolutionary.

The $3+ billion prop trading industry stands at a crossroads. Down one path lies continued growth, innovation, and expanded opportunities for traders worldwide. Down the other lies increased criminalization, excessive regulation, and the potential collapse of trust that makes the entire system possible.

The choice isn’t just up to prop firms – it’s up to every participant in the ecosystem. By understanding these threats, supporting legitimate operators, and maintaining vigilance against criminal activity, the trading community can help ensure that prop trading remains a force for financial democratization rather than criminal exploitation.

As a trader, equip yourself with trading skills, keep up with changes in regulatory compliance, and always prioritize firms with real safeguards. Copy trading and algorithmic trading might be tempting shortcuts, but long-term success lies in building trust, mastering various trading strategies, and staying informed.

FAQs

1. Why are prop trading firms being targeted by criminals?

Because prop firms hold large amounts of capital and accept high volumes of remote traders, they’re prime targets for identity fraud, bot abuse, and laundering. Many also lack consistent Know Your Customer (KYC) procedures, making it easier to onboard using stolen or synthetic identities.

2. How does money laundering work in prop firms?

Criminals fund accounts with illicit money, place minimal trades to appear legitimate, then withdraw “clean” profits – often via crypto or offshore methods. Weak anti-money laundering (AML) procedures in some firms make them ideal tools for obfuscating illicit financial activity.

3. Can bots really pass trading challenges?

Yes. Sophisticated bots can mimic human behavior, identify exploitable patterns, and pass challenges across multiple accounts. This creates an unfair advantage, distorts firm metrics, and threatens the legitimacy of funded trading programs.

4. What should traders look for in a good prop firm?

Look for firms with biometric or multi-step KYC, fair and transparent profit split terms, solid risk controls, and a clear, verifiable history of timely payouts and ethical business practices.

5. How do fake reviews impact prop firms?

Fake reviews and coordinated smear campaigns mislead traders and damage firm reputations. This can drive away top talent, erode trust, and even divert clients to fraudulent competitors pretending to be legitimate.